Updated on September 20th, 2024 by Bob Ciura

Data updated daily

Dividends are the most common method that a company can use to return capital to shareholders. Dividend growth investors often place significant emphasis on dividend yields and dividend growth as a result.

Naturally, dividend growth investors are attracted to high-quality stocks such as the Dividend Aristocrats, an exclusive group of stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

However, there are additional ways for companies to create value for shareholders.

In addition to dividends, share repurchases are also an important part of a healthy capital return program. Debt reduction should also be welcomed by investors.

Related: Learn more about share repurchases in the video below.

There is a single financial metric that incorporates each of these factors (dividend payments, share repurchases, and debt reduction). It is called shareholder yield – and stocks with high shareholder yields can make fantastic long-term investments.

With that in mind, the High Shareholder Yield Stocks List that you can download below contains 349 stocks with positive shareholder yields, meaning that they offer a dividend, buybacks, and/or debt reduction of some kind.

The spreadsheet list was derived from the Cambria Shareholder Yield ETF.

Keep reading this article to learn more about the merits of investing in stocks with above-average shareholder yields.

What Is Shareholder Yield?

To invest in the stocks with the highest shareholder yields, you have to find them first. The High Shareholder Yield Stocks List helps identify stocks with high shareholder yields.

Shareholder yield measure how much money a company is returning to its shareholder through dividend payments, share repurchases, and debt reduction.

It is expressed as a percent, and can be interpreted as the answer to the following question: ‘How much money will be returned to me through dividend payments, share repurchases, and debt reduction if I buy $100 of company stock?’

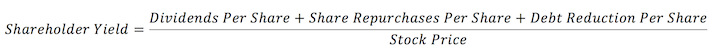

Mathematically, shareholder yield is defined as follows:

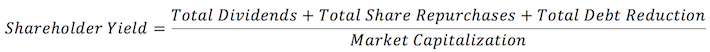

Alternatively, shareholder yield can be calculated using company-wide metrics (instead of per-share metrics).

The common sense interpretation of shareholder-yield is the percent of your invested money that is devoted to activities that are quantitatively shareholder-friendly (dividend payments, share repurchases, and debt reductions).

How To Use The High Shareholder Yield List To Find Dividend Investment Ideas

Having an Excel document full of stocks that have high shareholder yields can be very useful.

However, the true power of such a document can only be unlocked when its user has a rudimentary knowledge of how to use Microsoft Excel.

With that in mind, this section will provide a tutorial of how to implement two additional screens (in addition to the screen for high shareholder yields) to the High Shareholder Yield Spreadsheet List.

The first screen that will be implemented is a screen for stocks that are trading at a trailing price-to-earnings ratio less than 16.

Step 1: Download the High Shareholder Yield Spreadsheet List at the link above.

Step 2: Click on the filter icon at the top of the ‘PE Ratio’ column, as shown below.

Step 3: Change the filter setting to ‘Less Than’ and input ’16’ into the field beside it.

This will filter for stocks with high shareholder yields and forward price-to-earnings ratios below 16.

The next filter that will be implemented is for stocks with market capitalizations above $10 billion (which are called large capitalization – or ‘large cap’ – stocks).

Step 1: Download the High Shareholder Yield Spreadsheet List at the link above.

Step 2: Click on the filter icon at the top of the ‘Market Cap’ column, as shown below.

Step 3: Change the filter setting to ‘Greater Than’ and input 10000 into the next field. Since the market capitalization column is measured in millions of dollars, this will filter for stocks with market capitalizations higher than $10 billion (which represent the ‘large cap’ universe of stocks).

The remaining stocks in this Excel sheet are those with high shareholder yields and market capitalizations of $10 billion or higher.

Now that you have an understanding of how to use the High Shareholder Yield Stocks List, the remainder of this article will explain how to calculate & interpret shareholder yield and will also explain some of the benefits of investing in securities with high shareholder yields.

Why Invest In Stocks With High Shareholder Yields?

There are a number of benefits to investing in stocks with high shareholder yields.

The first and perhaps most obvious benefit to investing in high shareholder yield stocks is the knowledge that the company’s management has its shareholders’ best interests at heart.

A high shareholder yield indicates that dividend payments, share repurchases, and debt reductions are a top priority for management.

In other words, high shareholder yields are correlated with a corporate culture that emphasizes shareholder well-being.

The second and more important benefit to investing in stocks with high shareholder yields is that they have a proven record of delivering outsized total returns over meaningful periods of time.

This can be seen by looking at stock market indices that focus on stocks with high shareholder yields.

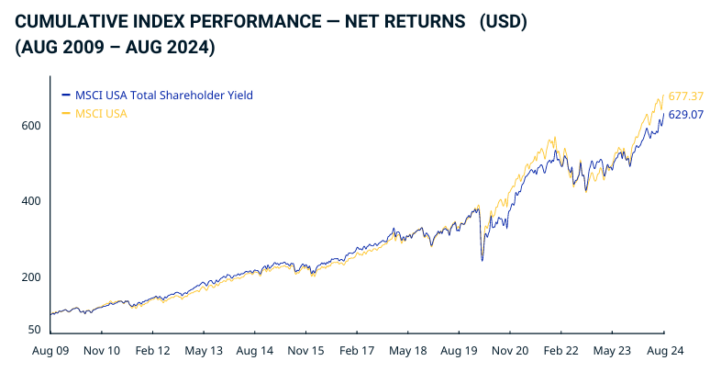

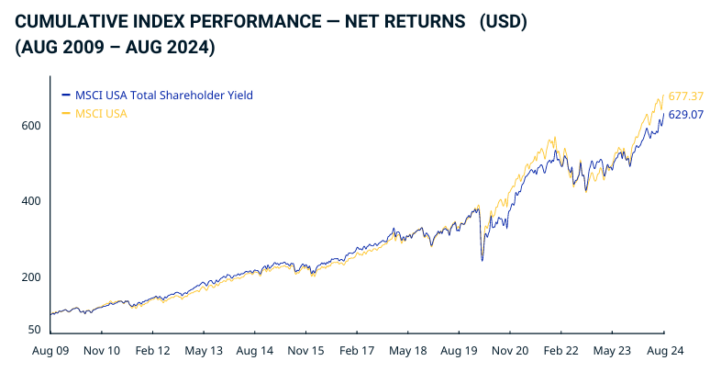

For instance, the image below compares the returns of the MSCI USA Total Shareholder Yield Index to a broader universe of domestic stocks – the MSCI USA Index.

Source: MSCI USA Total Shareholder Yield Fact Sheet

Since inception, the MSCI USA Total Shareholder Yield Index has outperformed the broader index, delivering annualized returns of 7.88% per year compared with 7.25% for the MSCI USA Index.

Why is this especially impressive?

Well, it is because the past 5 years have witnessed a robust bull market and a corresponding increase in asset prices.

A significant component of shareholder yield is share repurchases. Share repurchases occur when a company buys back its stock for cancellation, increasing the part ownership of each continuing shareholders.

Importantly, share repurchases are significantly more effective during bear markets than during bull markets because the same dollar value of share repurchases can buy back a larger amount of company stock.

This common-sense characteristic of high shareholder yield stocks – that they should outperform during recessions – is an admirable trait and should be appreciated by investors who incorporate shareholder yield into their investment strategy.

But it is also impressive that these stocks have also outperformed in the past 5 years.

Top 5 Shareholder Yield Stocks Now

This section will rank the top 5 shareholder yield stocks from the spreadsheet that are covered in the Sure Analysis Research Database.

The following 5 shareholder yield stocks are ranked by 5-year annual expected returns, from lowest to highest.

Shareholder Yield Stock #5: Estee Lauder Companies (EL)

- 5-year annual expected returns: 15.9%

Estee Lauder is one of the world’s largest cosmetics and beauty care companies. It competes primarily in the upscale and prestige portion of the market. Sales break down as follows: Skin care makes up 52% of sales, makeup constitutes 28%, fragrance is another 16%, and hair care is the other 4%.

The leading brands include the namesake Estee Lauder along with Clinique, Aveda, M.A.C., and Origins among others. Estee Lauder is a truly international firm, operating in more than 150 countries. Revenues are split almost equally in thirds between the Asia-Pacific, Europe Middle East & Africa, and the Americas segments.

The company reported its Q4 and full-year 2024 results on August 19th, 2024. Earnings-per-share of 64 cents declined from $1.08 for the same period of last year, but topped expectations. Revenues of $3.9 billion increased 7% year-over-year, marking a healthy reversal from the company’s recent sales declines.

Click here to download our most recent Sure Analysis report on EL (preview of page 1 of 3 shown below):

Shareholder Yield Stock #4: Perrigo Company (PRGO)

- 5-year annual expected returns: 18.3%

Perrigo is headquartered in Ireland. It operates in the healthcare sector as a manufacturer of over-the-counter consumer products.

Its Consumer Self-Care Americas segment is comprised of the U.S., Mexico and Canada consumer healthcare businesses. The Consumer Self-Care International segment includes branded consumer healthcare business primarily in Europe, but also Australia and Israel. The company generates ~$4.7 billion in annual revenue.

On August 2nd, 2024, Perrigo announced second quarter earnings results for the period ending June 30th, 2024. For the quarter, revenue decreased 10.7% to $1.1 billion, which was $60 million less than expected. Adjusted earnings-per-share of $0.53 compared unfavorably to $0.63 in the prior year, but this was $0.07 above estimates.

Organic revenue decreased 9.1% for the period. Consumer Self-Care Americas’ organic sales were down 15.1% due to weaker infant formula results and a product prioritization. Outside of Women’s Health and Healthy Lifestyle, all product categories were lower from the prior year.

Click here to download our most recent Sure Analysis report on PRGO (preview of page 1 of 3 shown below):

Shareholder Yield Stock #3: Alphabet Inc. (GOOG) (GOOGL)

- 5-year annual expected returns: 19.4%

Alphabet is a holding company. With a market capitalization that exceeds $2 trillion, Alphabet is a technology conglomerate that operates several businesses such as Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and many more. Alphabet is a leader in many of the areas of technology that it operates.

Alphabet has a market cap above $2 trillion, making it a mega-cap stock.

There are two classes of Alphabet stock, Class A shares, which has voting rights, and Class C shares, that do not have voting rights. This report will reference the Class A shares. On July 23rd, 2024, Alphabet declared its second ever quarterly dividend of $0.20 per share.

Also on July 23rd, 2024, Alphabet announced second quarter results for the period ending June 30th, 2024. As had been the case for several quarters, the company delivered better than expected results.

Revenue improved 13.6% to $84.7 billion for the period, topping analysts’ estimates by $450 million. Adjusted earnings-per-share of $1.89 compared very favorably to $1.44 in the prior year and was $0.04 more than expected.

Click here to download our most recent Sure Analysis report on GOOGL (preview of page 1 of 3 shown below):

Shareholder Yield Stock #2: Baxter International (BAX)

- 5-year annual expected returns: 22.5%

Baxter International develops and sells a variety of healthcare products, including biological products, medical devices, and connected care services devices used to monitor patients. Its products are used in hospitals, kidney dialysis centers, nursing homes, doctors’ offices, and patients at home under physician supervision.

On August 6th, 2024, Baxter International reported second quarter earnings results for the period ending June 30th, 2024. For the quarter, revenue grew 2.8% to $3.81 billion, which was $60 million above estimates. Adjusted earnings-per share of $0.68 compared favorably to $0.55 in the prior year and was $0.02 better than expected.

Starting with Q3 2023, the company now has four reportable business segments. All of the businesses within the company showed year-over-year growth on a constant currency basis. Excluding the impact of currency exchange, Kidney Care revenue was higher by 3% to $1.1 billion.

Medical Products & Therapies grew 5% to $1.32 billion, Healthcare Systems & Technologies was up 1% to $748 million, and Pharmaceuticals increased 9% to $602 million. The adjusted gross margin expanded 80 basis points to 41.2%.

Click here to download our most recent Sure Analysis report on BAX (preview of page 1 of 3 shown below):

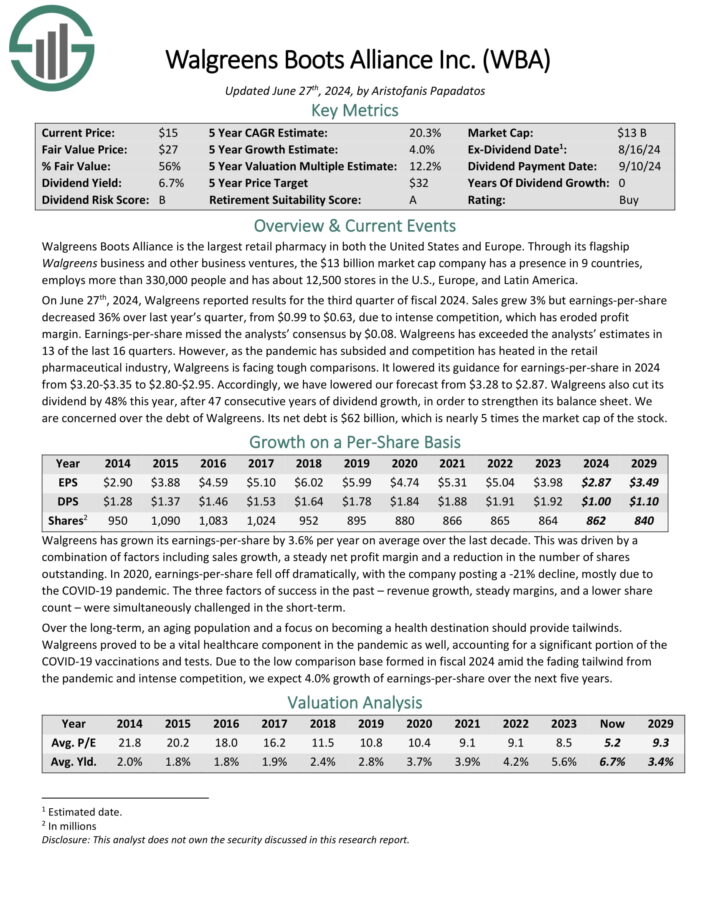

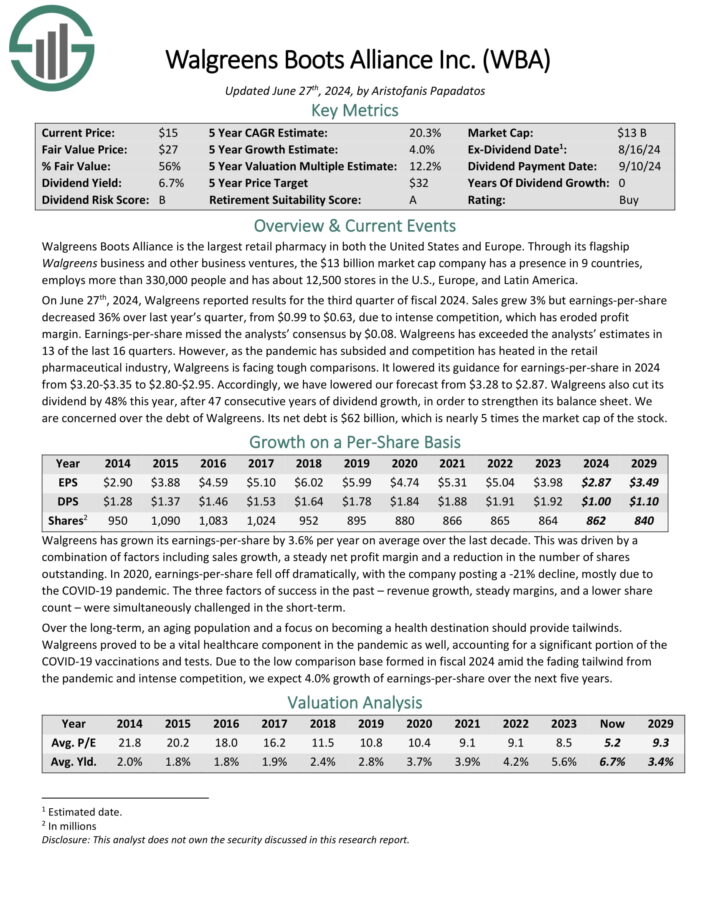

Shareholder Yield Stock #1: Walgreens Boots Alliance (WBA)

- 5-year annual expected returns: 15.9%

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the $13 billion market cap company has a presence in 9 countries, employs more than 330,000 people and has about 12,500 stores in the U.S., Europe, and Latin America.

On June 27th, 2024, Walgreens reported results for the third quarter of fiscal 2024. Sales grew 3% but earnings-per share decreased 36% over last year’s quarter, from $0.99 to $0.63, due to intense competition, which has eroded profit margin.

Source: Investor Presentation

Earnings-per-share missed the analysts’ consensus by $0.08. Walgreens has exceeded the analysts’ estimates in 13 of the last 16 quarters.

However, as the pandemic has subsided and competition has heated in the retail pharmaceutical industry, Walgreens is facing tough comparisons. It lowered its guidance for earnings-per-share in 2024 from $3.20-$3.35 to $2.80-$2.95. Accordingly, we have lowered our forecast from $3.28 to $2.87.

Click here to download our most recent Sure Analysis report on WBA (preview of page 1 of 3 shown below):

Other Sources of Compelling Investment Ideas

Stocks with high shareholder yields often make fantastic investment opportunities.

However, they are not the only signs that a company’s management has the best interest of its shareholders at heart. Moreover, shareholder yields are only one (there are many others) of the quantitative signals that a stock may deliver market-beating performance over time.

One of our preferred signals for the shareholder-friendliness and future prospects of a company is a long dividend history. A lengthy history of steadily increasing dividend payments is indicative of a durable competitive advantage and a recession-proof business model.

With that in mind, the following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

Investors can also look to the dividend portfolios of successful, institutional investors for high-quality dividend investment ideas.

Large portfolio managers with $100 million or more of assets under management must disclose their holdings in quarterly 13F filings with the U.S. Securities & Exchange Commission.

Sure Dividend has analyzed the equity portfolios of the following high-profile investors in detail:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.