As a SaaS CFO, I know how tough it is to get ARR reporting right.

Nonstandard definitions. Edge cases. 300-line SQL queries. The list goes on.

The Equals team has decades of experience standing up ARR reporting at Intercom, Stripe, Box, Atlassian, and dozens of other companies.

They’ve packed their expertise into The Ultimate Guide to ARR. It covers everything you need to know to define, build, and report on ARR from scratch.

This is a must-read. And it’s completely free.

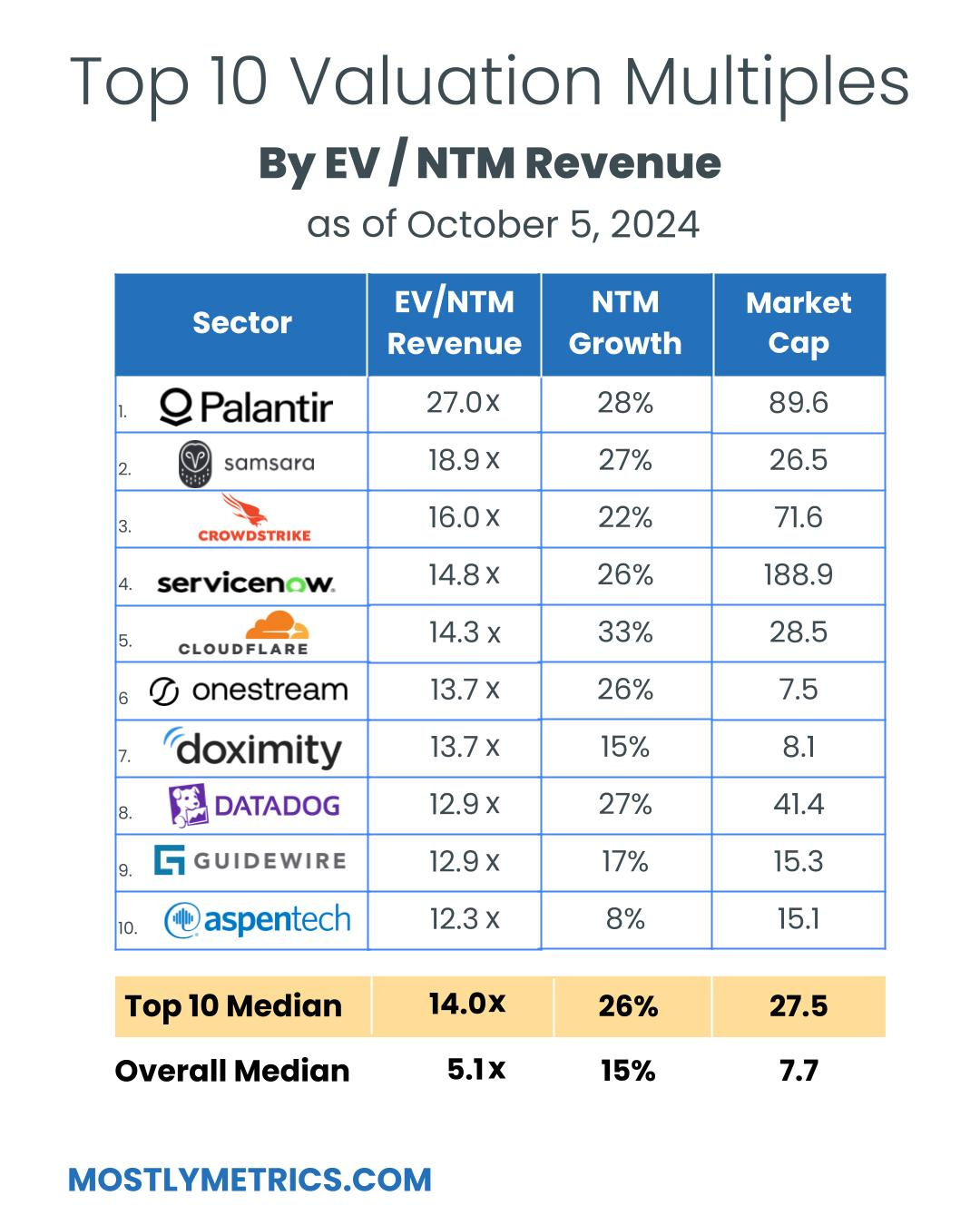

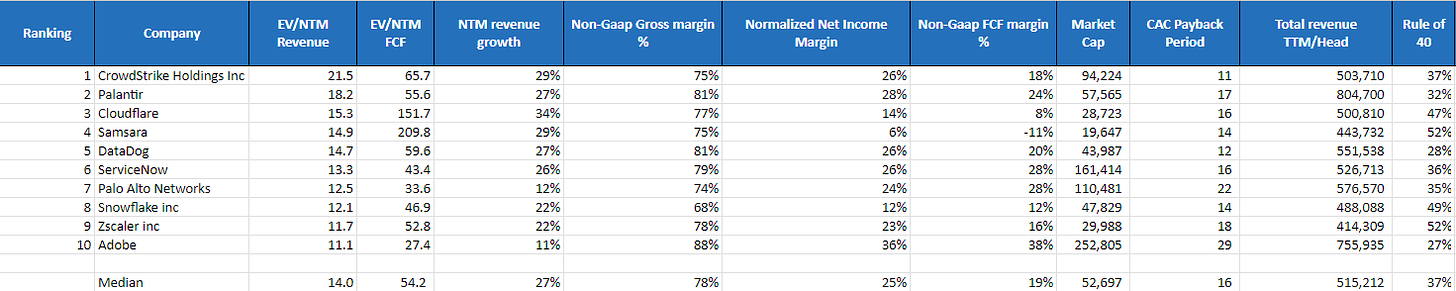

Palantir is trading at 27x forward revenues, nearly 5x the median publicly traded tech company and double the top ten median.

The stock is up 141% year to date, thanks in part to the AI wave, and has almost quintupled since 2022. And last week it officially made it into the S&P 500.

Palantir’s financials are really solid. Their Rule of 40 is 57%, and their revenue is actually expected to accelerate next year.

But the valuation they’re garnering goes above and beyond the numbers – it’s about people (namely retail investors) buying into their narrative.

And this allows Palantir to pull the future forward.

Palantir’s CEO Alex Karp has a cult-like following. And the way he tells the company’s story, shrouded with a heavy dose of mystery, enables him to walk the line between cheap capital and a combustible valuation.

Palantir is getting credit for revenues far out into the future. Instead of looking 12 months out, investors are theoretically pulling forward their revenues from a distant far off land, perhaps more than three years out.

Make no mistake – this wouldn’t be possible if Palantir was not already crushing it. They’re putting numbers on the board, and have long term contracts with government agencies who aren’t going anywhere. And then, on top of that, they layer in the power of narrative. The best CEOs leverage this as a super power to pull the future forward.

Prof. Scott Galloway recently commented on this:

“As a CEO you’re trying to tell a story such that you can pull the future forward, right…

That ability to raise capital at a cheaper price than your competitors gives you the ability to pull the future forward and maybe grow into that stock price.

So what this guy’s done is absolutely, I think he’s being a great fiduciary. His employees are getting rich and he’s now gonna have access to cheaper capital to build out infrastructure technology, hire better, brighter, faster, smarter people and make investments his competitors can’t keep up with and sort of pull away with it. And that’s kind of the job of a CEO.”

-The Prof G Show on Spotify

In 2020 and 2021, every tech CEO got to pull the future forward (even the not so credible story tellers).

Most are still growing into that future they mortgaged.

The question becomes how far is too far? When have you lost the plot? When have you jumped the shark?

Palantir seems to be teetering on the edge. They trade a full eight turns higher than the next highest EV / NTM Revenue company, Samsara, at 18.9x.

Keep in mind – traditionally anything over 10x forward revenue is considered a “premium” valuation.

This newsletter is not about picking stocks. I have a team of monkeys throwing darts in the back room who shoulder that burden.

This newsletter is an exploration of metrics, business models and strategic narratives. Palantir operates at the nexus of all three. And the ingredients they’re working with are fascinating.

For operators out there working on their own stories, watch this one to see how much is too much before the recipe spoils.

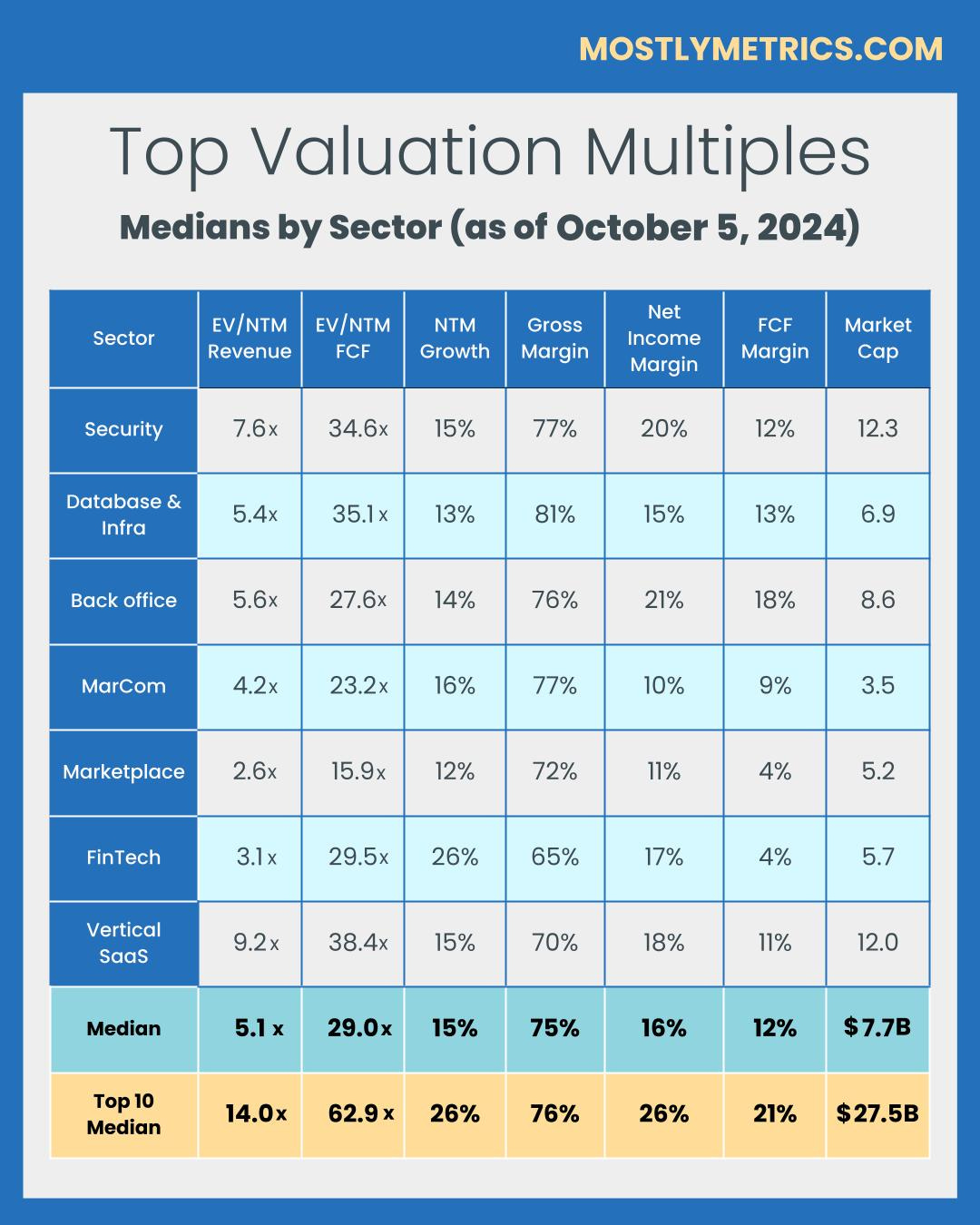

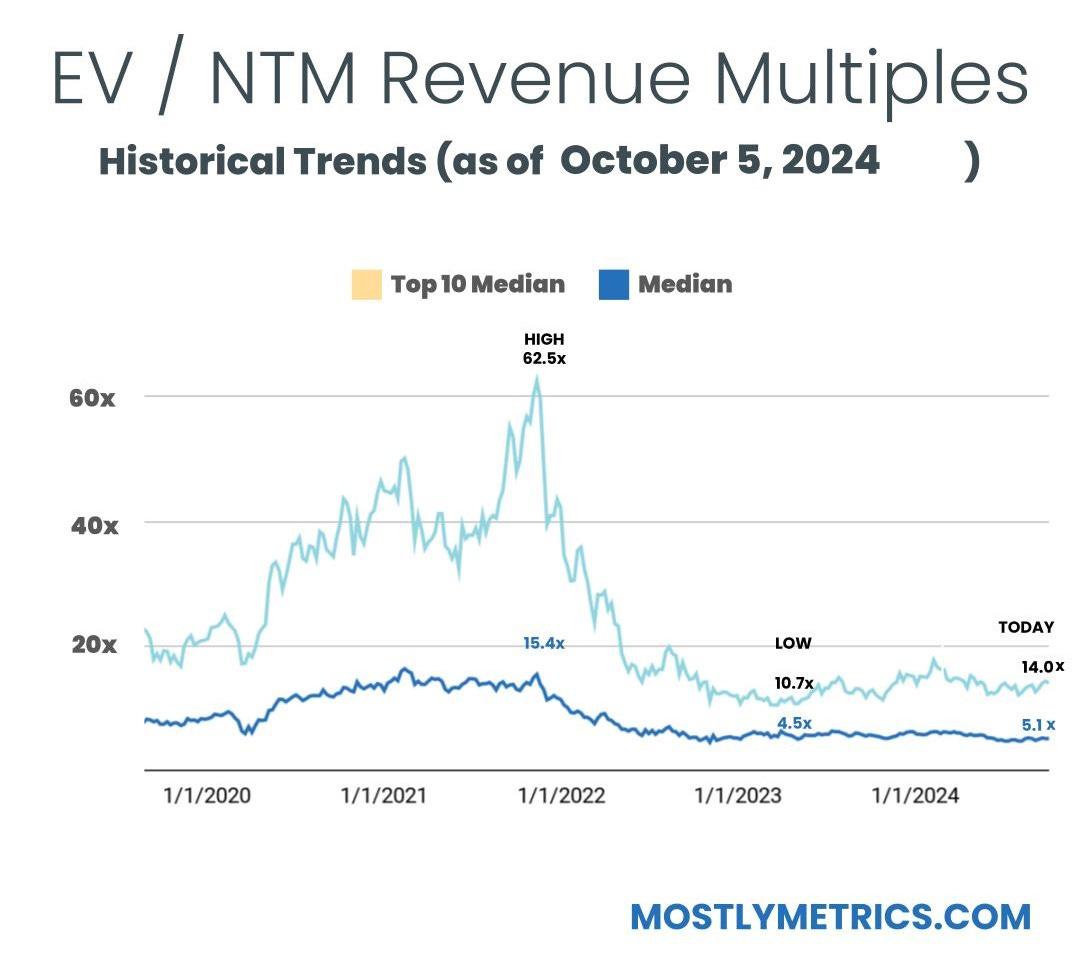

TL;DR: Multiples are DOWN week-over-week.

Top 10 Medians:

Revenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis.

NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality.

However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”.

Reasons may include:

From a macro perspective, multiples trend higher in low interest environments, and vice versa.

Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Enterprise Value is calculated as: Market Capitalization + Total Debt – Cash

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week – to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop.

Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies.

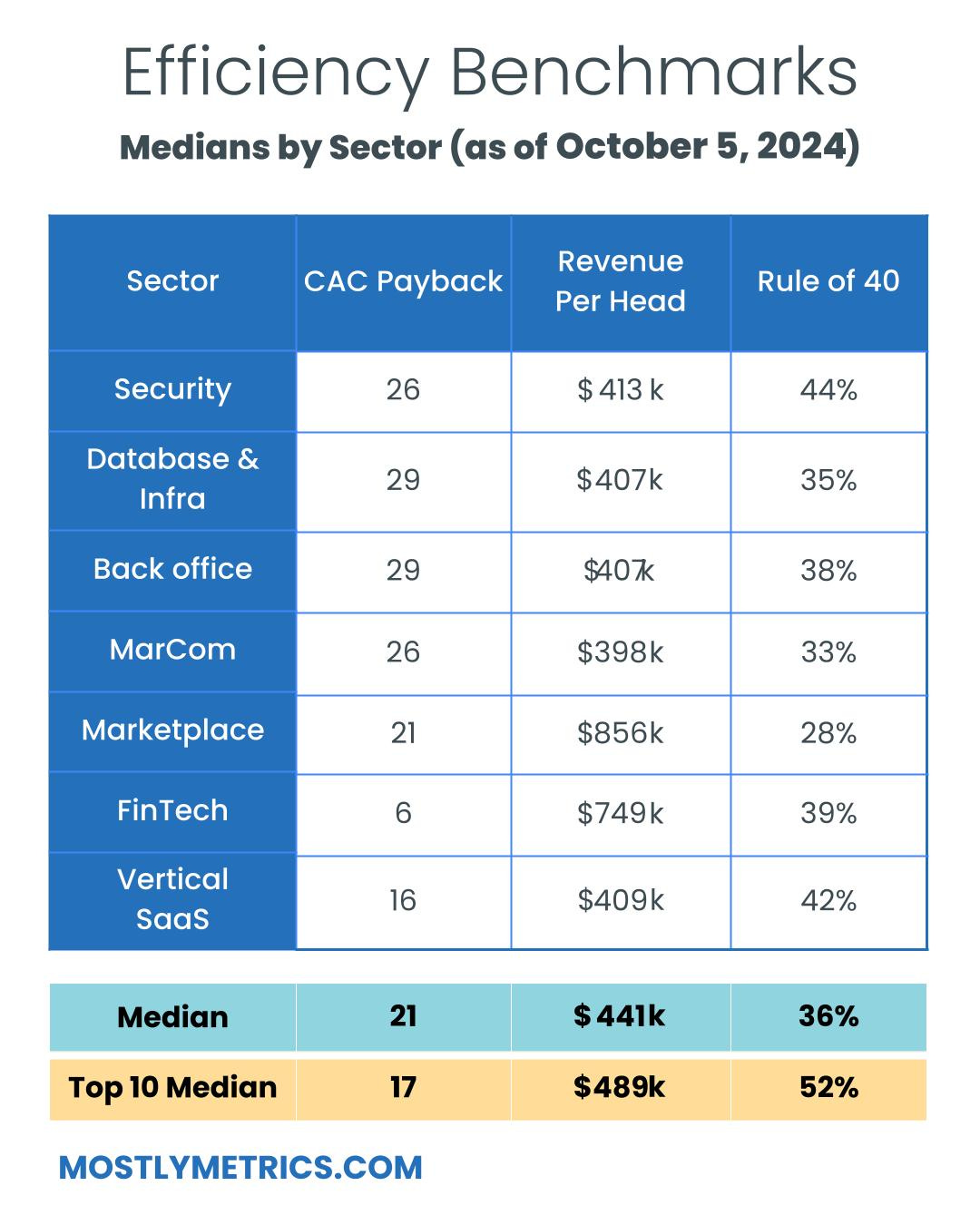

Companies that can do more with less tend to earn higher valuations.

Three of the most common and consistently publicly available metrics to measure efficiency include:

CAC Payback Period is measured as Sales and Marketing costs divided by Revenue Additions, and adjusted by Gross Margin.

Here’s how I do it:

Sales and Marketing costs are measured on a TTM basis, but lagged by one quarter (so you skip a quarter, then sum the trailing four quarters of costs). This timeframe smooths for seasonality and recognizes the lead time required to generate pipeline.

Revenue is measured as the year-on-year change in the most recent quarter’s sales (so for Q2 of 2024 you’d subtract out Q2 of 2023’s revenue to get the increase), and then multiplied by four to arrive at an annualized revenue increase (e.g., ARR Additions).

Gross margin is taken as a % from the most recent quarter (e.g., 82%) to represent the current cost to serve a customer

-

Revenue per Employee: On a per head basis, how much in sales does the company generate each year? The rule of thumb is public companies should be doing north of $450k per employee at scale. This is simple division. And I believe it cuts through all the noise – there’s nowhere to hide.

Revenue per Employee is calculated as: (TTM Revenue / Total Current Employees)

Rule of 40 is calculated as: TTM Revenue Growth % + TTM Adjusted EBITDA Margin %

A few other notes on efficiency metrics:

-

Net Dollar Retention is another great measure of efficiency, but many companies have stopped quoting it as an exact number, choosing instead to disclose if it’s above or below a threshold once a year. It’s also uncommon for some types of companies, like marketplaces, to report it at all.

-

Most public companies don’t report net new ARR, and not all revenue is “recurring”, so I’m doing my best to approximate using changes in reported GAAP revenue. I admit this is a “stricter” view, as it is measuring change in net revenue.

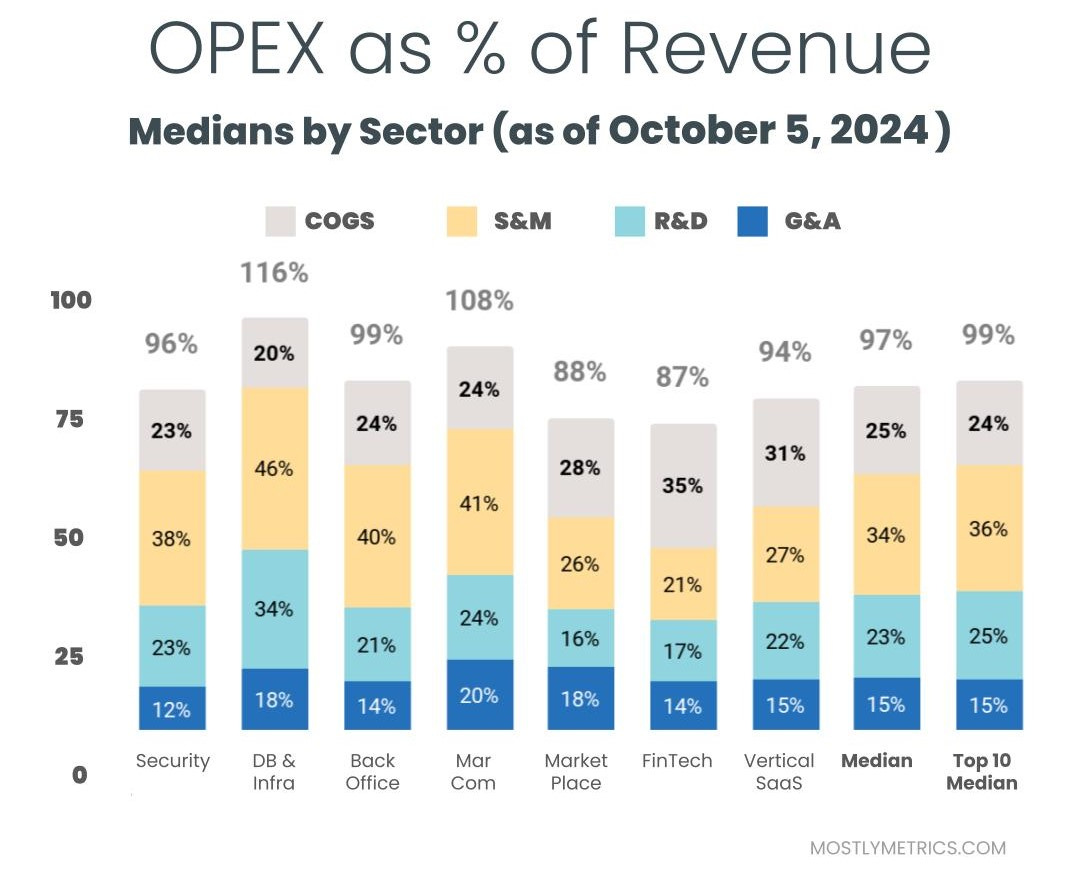

Decreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale.

The most common buckets companies put their operating costs into are:

-

Cost of Goods Sold: Customer Support employees, infrastructure to host your business online, API tolls, and banking fees if you are a FinTech.

-

Sales & Marketing: Sales and Marketing employees, advertising spend, demand gen spend, events, conferences, tools

-

Research & Development: Product and Engineering employees, development expenses, tools

-

General & Administrative: Finance, HR, and IT employees… and everything else. Or as I like to call myself “Strategic Backoffice Overhead”

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense.

Want to build your own comp set?

Upgrade to paid to download the company level workbook.