Updated on October 16th, 2024 by Bob Ciura

Oil and gas royalty trusts are now offering exceptionally high distributions to their investors, resulting in much higher yields than the ~1.3% average dividend yield of the S&P 500.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will discuss the prospects of the 5 highest-yielding royalty trusts.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

High-Yield Royalty Trust No. 5: Permian Basin Royalty Trust (PBT)

Permian Basin Royalty Trust is an oil and gas trust, which was founded in 1980. In 2023, about 55% of output was oil and 45% was gas, but 85% of revenues came from oil.

PBT is a combination trust: unit holders have a 75% net overriding royalty interest in Waddell Ranch Properties in Texas, which includes several oil and gas wells; and a 95% net overriding royalty interest in the Texas Royalty Properties, which includes various oil wells.

The trust’s assets are static in that no further properties can be added. The trust has no operations but is merely a pass through vehicle for the royalties. PBT had royalty income of $54.4 million in 2022 and $29.0 million in 2023.

In early August, PBT reported (8/8/24) financial results for the second quarter of fiscal 2024. Oil and gas volumes decreased but the average realized price of oil significantly improved over the prior year’s period. As a result, distributable income per unit grew 50%, from $0.12 to $0.18.

After some months of disappointing distributions, which resulted from high operating expenses on the Waddell Ranch properties, PBT boosted its distributions in the last two months of 2023. However, it has reduced them again this year due to high operating expenses on the Waddell Ranch properties and low gas prices amid unfavorable weather.

Click here to download our most recent Sure Analysis report on Permian Basin Royalty Trust (PBT) (preview of page 1 of 3 shown below):

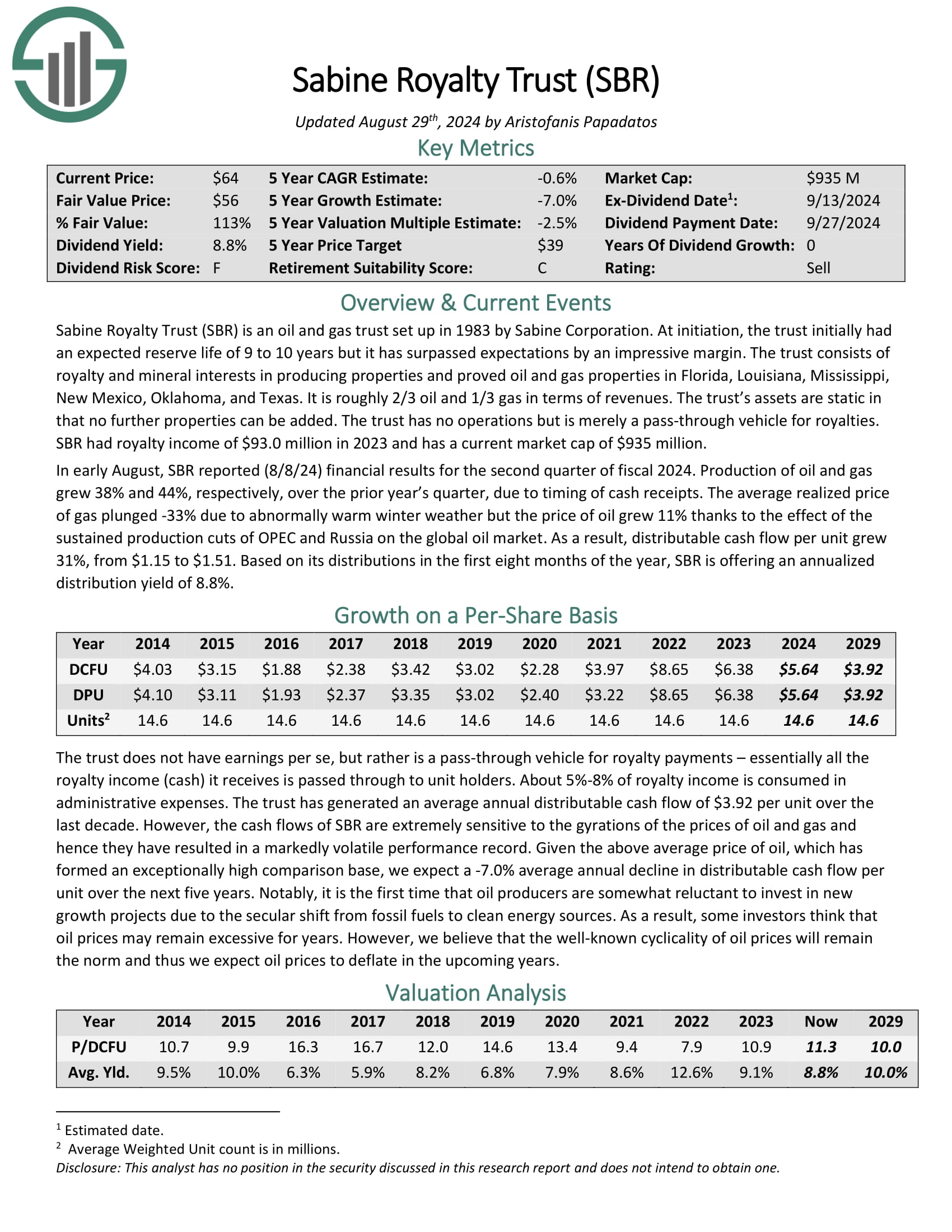

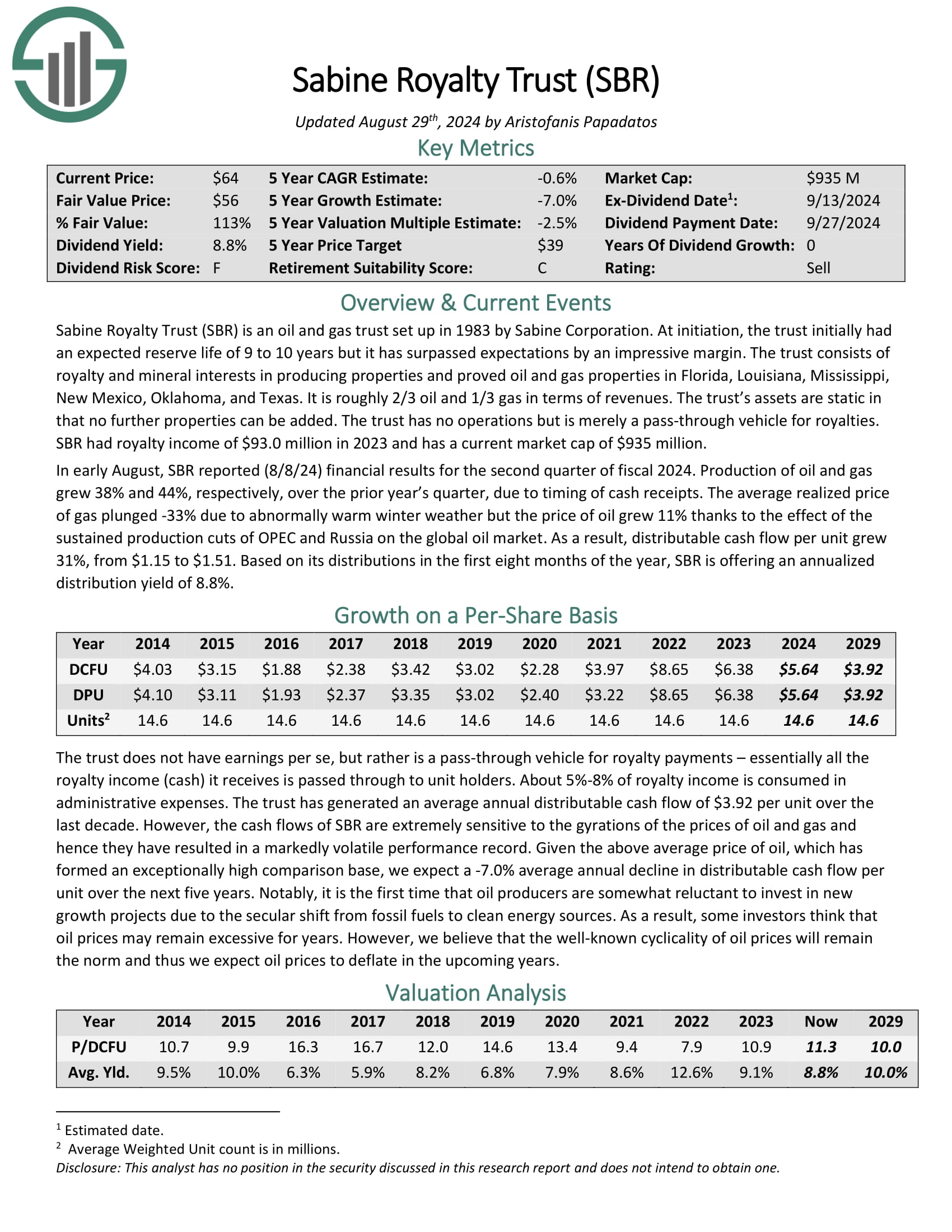

High-Yield Royalty Trust No. 4: Sabine Royalty Trust (SBR)

Sabine Royalty Trust is an oil and gas trust that was formed in 1983 by Sabine Corporation. It consists of royalty and mineral interests in producing properties and proved oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas.

It generates approximately two-thirds of its revenues from oil and one-third of its revenues from gas. The trust has static assets, i.e., it cannot add new properties to its asset portfolio. Sabine Royalty Trust has no operations but is merely a pass-through vehicle for royalties.

In early August, SBR reported (8/8/24) financial results for the second quarter of fiscal 2024. Production of oil and gas grew 38% and 44%, respectively, over the prior year’s quarter, due to timing of cash receipts.

The average realized price of gas plunged -33% due to abnormally warm winter weather but the price of oil grew 11% thanks to the effect of the sustained production cuts of OPEC and Russia on the global oil market.

As a result, distributable cash flow per unit grew 31%, from $1.15 to $1.51.

Click here to download our most recent Sure Analysis report on Sabine Royalty Trust (SBR) (preview of page 1 of 3 shown below):

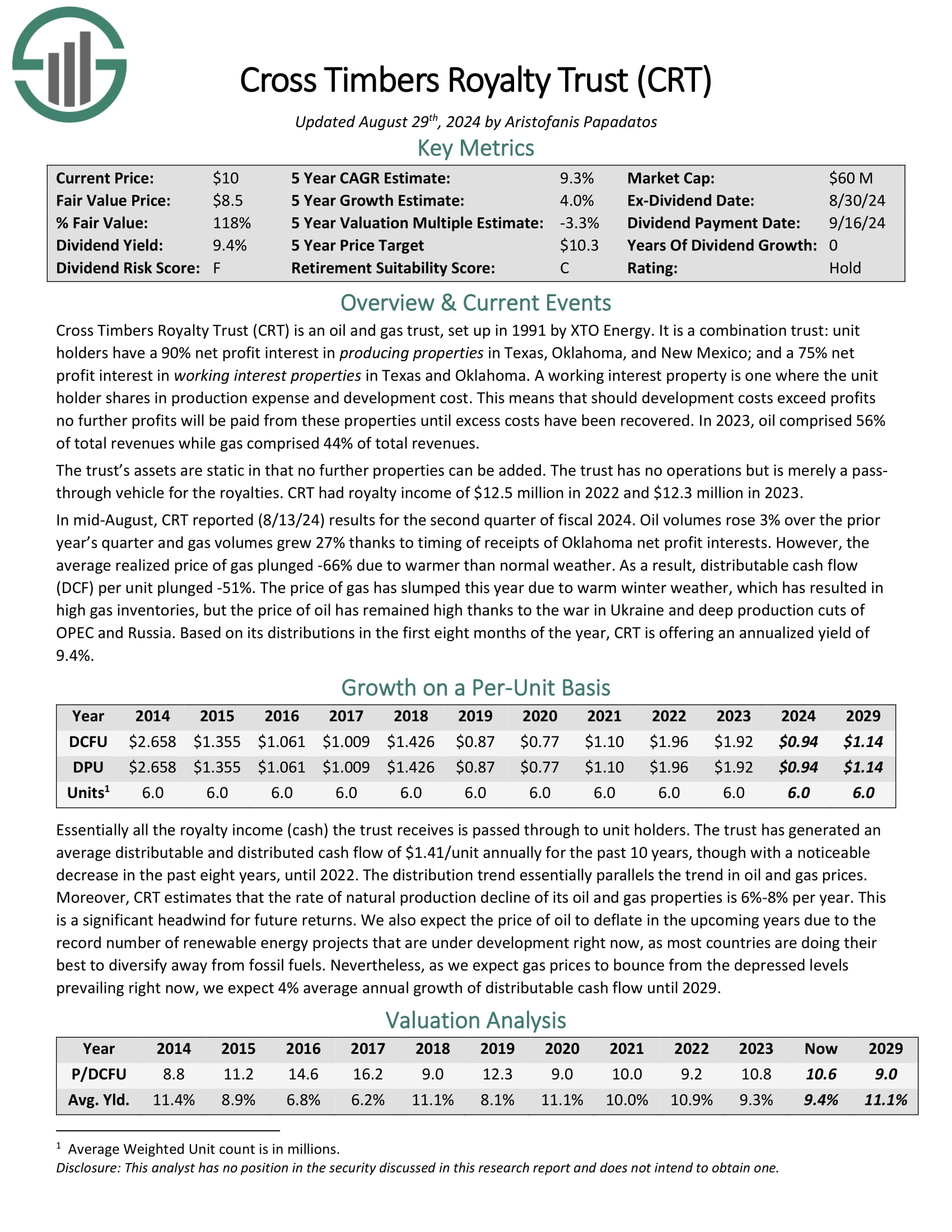

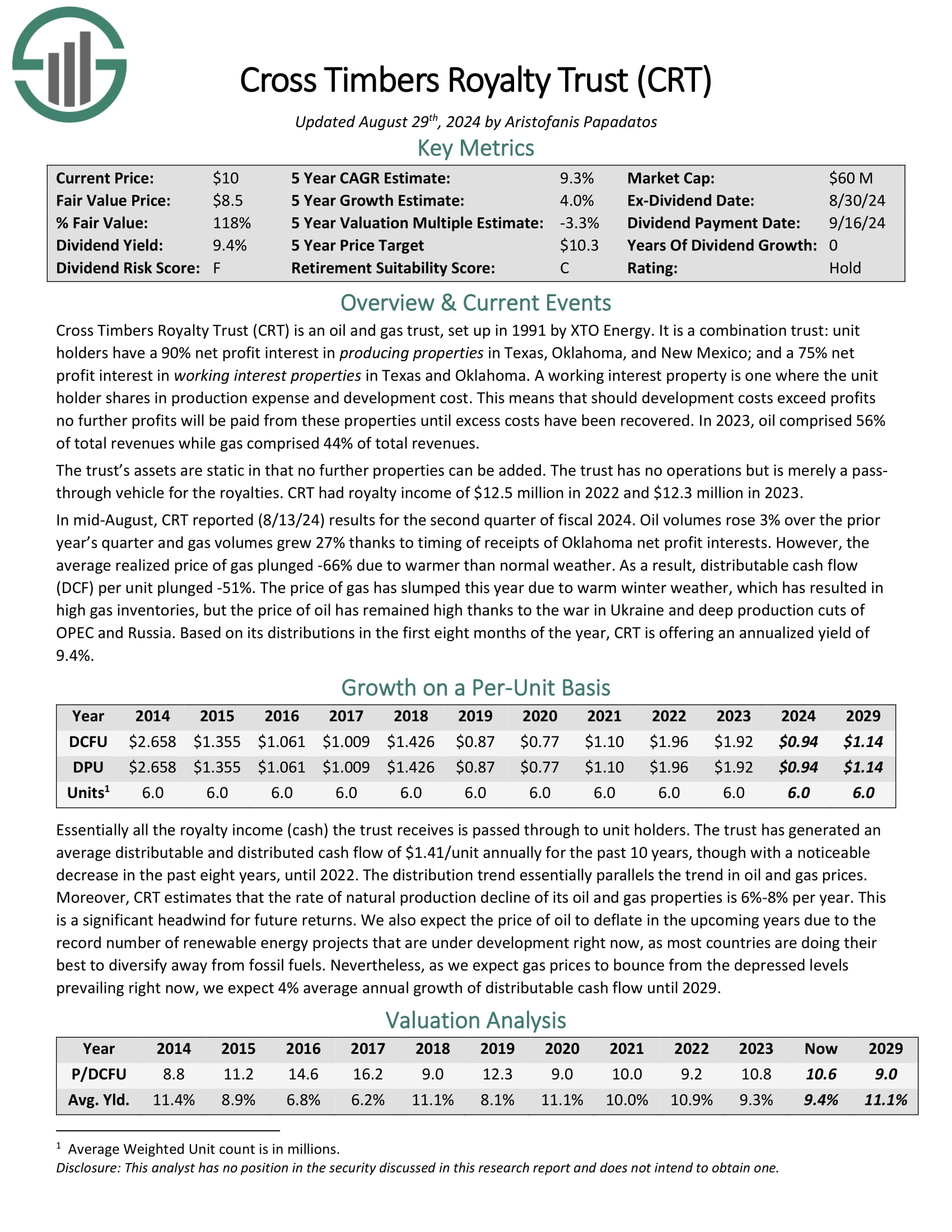

High-Yield Royalty Trust No. 3: Cross Timbers Royalty Trust (CRT)

Cross Timbers Royalty Trust is an oil and gas trust (about 50/50), set up in 1991 by XTO Energy. Its unitholders have a 90% net profit interest in producing properties in Texas, Oklahoma, and New Mexico; and a 75% net profit interest in working interest properties in Texas and Oklahoma.

In mid-August, CRT reported (8/13/24) results for the second quarter of fiscal 2024. Oil volumes rose 3% over the prior year’s quarter and gas volumes grew 27% thanks to timing of receipts of Oklahoma net profit interests.

However, the average realized price of gas plunged -66% due to warmer than normal weather. As a result, distributable cash flow (DCF) per unit plunged -51%.

Click here to download our most recent Sure Analysis report on Cross Timbers Royalty Trust (CRT) (preview of page 1 of 3 shown below):

High-Yield Royalty Trust No. 2: Permianville Royalty Trust (PVL)

Permianville Royalty Trust (PVL) was incorporated in 2011 and is based in Houston, Texas. It operates as a statutory trust and owns a net profits interest representing the right to receive 80% of the net profits from the sale of oil and natural gas production from properties located in the states of Texas, Louisiana and New Mexico.

It has a market capitalization of $63 million. The trust’s assets are static in that no further properties can be added. In addition, the trust is passive, as it has no control over operating costs and the rate of production.

In mid-August, PVL reported (8/14/24) financial results for the second quarter of fiscal 2024. Oil volumes grew 81% thanks to new Permian wells but gas prices plunged -39% amid abnormally warm winter weather. As a result, there was no distributable income.

PVL suspended its distributions in the first half of this year, as its operating expenses exceeded its operating income, primarily due to depressed gas prices. However, as we expected, the trust resumed distributions.

Click here to download our most recent Sure Analysis report on PVL (preview of page 1 of 3 shown below):

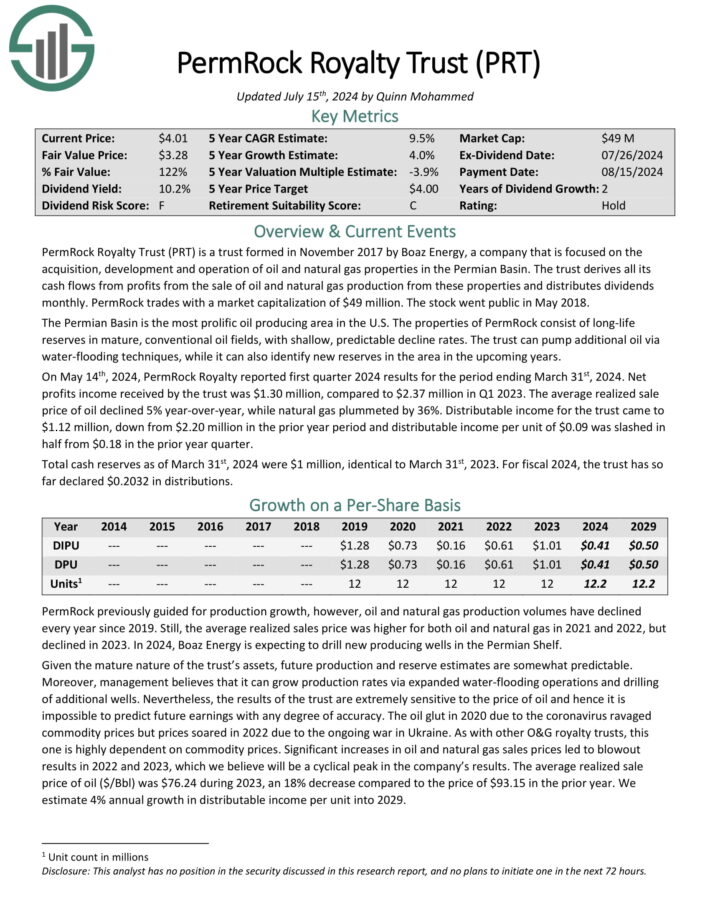

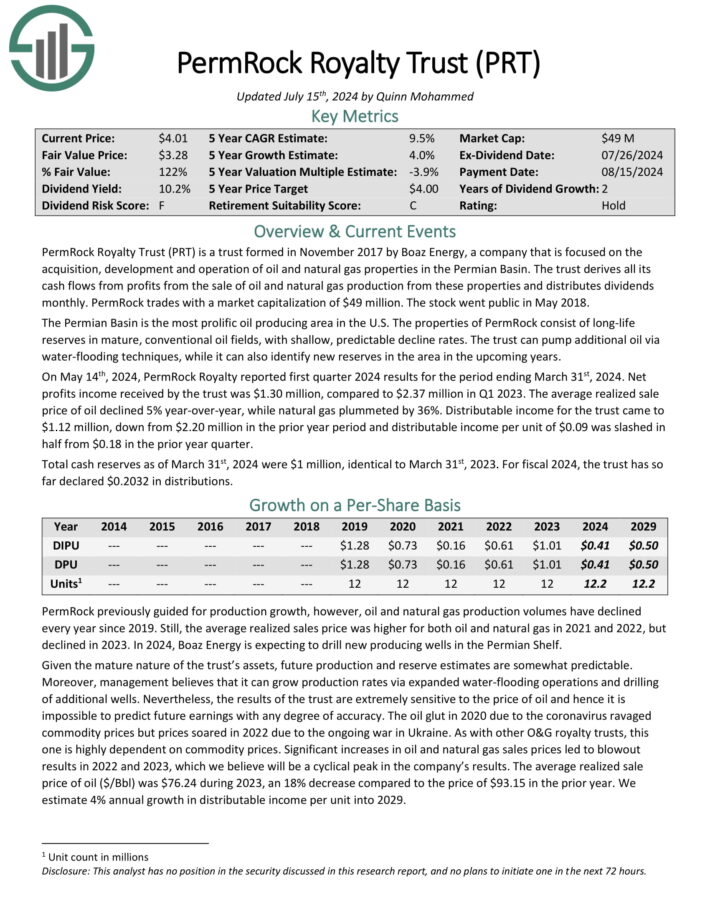

High-Yield Royalty Trust No. 1: PermRock Royalty Trust (PRT)

PermRock Royalty Trust is a trust formed in late 2017 by Boaz Energy, a company that is focused on the acquisition, development and operation of oil and natural gas properties in the Permian Basin. The Trust benefits from the unique characteristics of the Permian Basin, which is the most prolific oil-producing area in the U.S.

On May 14th, 2024, PermRock Royalty reported first quarter 2024 results for the period ending March 31st, 2024. Net profits income received by the trust was $1.30 million, compared to $2.37 million in Q1 2023. The average realized sale price of oil declined 5% year-over-year, while natural gas plummeted by 36%.

Distributable income for the trust came to $1.12 million, down from $2.20 million in the prior year period and distributable income per unit of $0.09 was slashed in half from $0.18 in the prior year quarter.

Click here to download our most recent Sure Analysis report on PermRock Royalty Trust (PRT) (preview of page 1 of 3 shown below):

Final Thoughts

On the surface, oil and gas royalty trusts are attractive as they widely offer higher yields than the S&P 500 average.

All the oil and gas trusts thrived in 2022 thanks to the exceptionally high prices of oil and gas, which resulted from the sanctions of western countries on Russia.

However, oil and gas prices are infamous for their dramatic swings. Oil prices have been on a downtrend for the past several months.

Therefore, investors should be prepared for much lower distributions from royalty trusts going forward. They should also be aware of the excessive risk of all these trusts near the peak of their cycle.

The ideal time to buy these trusts is during a severe downturn of the energy sector, when these stocks plunge and thus become deeply undervalued from a long-term perspective.

As mentioned above, all the oil and gas trusts are highly risky due to the natural decline of their production and their sensitivity to the prices of oil and gas.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.