This Alpha Picks Review explores if this investing group lives up to the hype by outperforming the S&P 500 by nearly 2.7x as of October 2024.

Quick Summary:

Alpha Picks is a Seeking Alpha investing group run by a former hedge fund manager who is now a portfolio manager analyst at Seeking Alpha.

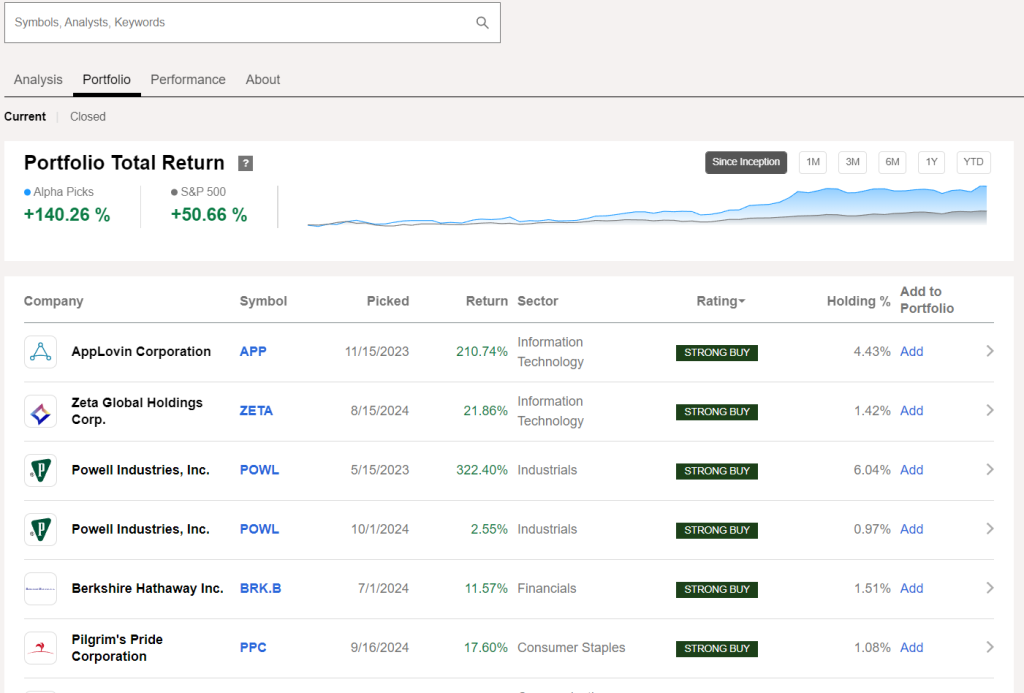

Every month, subscribers receive 2 new stock picks backed by the analysts’ research. Since 2022, Alpha Picks has returned 140%, vs. 50%, outperforming the S&P 500 by over 2.7X as of October 2024.

Best For:

Buy and hold investors

Capital appreciation-oriented investors

PROS

- Outperformed S&P 500 2.7X

- Reasonably Priced

- Community engagement

CONS

- Requires familiarity with the Alpha Rating system

- Requires some investing knowledge

Features:

2 new stock picks per month

Exclusive investing articles

Nearly real-time trade alerts

Mobile App?

Yes, through the Seeking Alpha App

Current Promotions:

Save $50 off your first year

What is Alpha Picks?

Alpha Picks is Seeking Alpha’s in-house investing group.

Alpha Picks is a stand-alone investing group that is part of Seeking Alpha’s “Investing Groups.”

As I noted in my Seeking Alpha Review, Seeking Alpha hosts several contributor-based investing groups, but this investing group is run by investing professionals hired by Seeking Alpha.

Alpha Picks subscribers get 2 monthly stock picks selected by their in-house investment team run by Steven Cress, a former Hedge Fund Manager and senior trader at investment banking powerhouse Morgan Stanley.

Every month, Steve provides an overview of the portfolio via webinar and the portfolio’s holdings.

So far, the portfolio’s performance has been stellar— since inception returning approximately 140% vs. 50% for the S&P 500 as of October 2024.

Alpha Picks Returns

Since its inception in 2022, Alpha Picks returned 140% vs. 50% for the S&P 500 over the same period. While Alpha Picks returns are good for the year, a 2.5-year time horizon barely scratches the surface for an investor.

Like most portfolios nowadays, it does hold some popular tech stocks like Meta, Google, and SalesForce, but honestly, I’ve never heard of most of the companies in the portfolio.

The portfolio consists of approximately 30 stocks, with individual stock weightings between 2-4% of the total holdings, with a few outliers.

Every month, Steve and his team provide a webinar update to discuss portfolio holdings and market updates like macro themes like inflation and interest rates. I’ve watched the webinars – they are about 30 minutes long, and Steve robotically reads off a prompter.

Not all returns are created equal – let’s dig into the data:

Approximately 24% of the holdings are in the Industrial sector, followed by 19% in Energy, 17% in Information Technology, and 16% in Consumer Discretionary.

Most of the portfolio’s returns are driven by one stock, Super Micro Computer, Inc., which has returned over 234% since its purchase and constitutes nearly 9% of its holdings.

I checked my Morningstar account and saw that Super Micro Computer has a beta of 1.28, meaning the stock is 28% more sensitive than the overall stock market, so it’s logical that the stock has generated solid performance over the past year.

Portfolio Holdings At A Glance

Number of Holdings: 30

Weightings: Individual stocks between 2 – 4% of total holdings

Top 3 Holdings: Super Micro Computer Inc, M/I Homes, Modine Manufacturing

Top 3 Sectors: Industrial, Energy, Information Technology

Weighted Average Portfolio Beta: 1.06

Investment Process

Below I explore Alpha Pick’s buying and selling criteria and how they perform their investment analysis.

Buying Criteria

Alpha Picks uses a data-driven process to identify the most appropriate stock picks from Seeking Alpha Premium’s quant recommendations.

The team selects two ‘Strong Buy’ rated stocks per month. One pick is added on the first trading day of the month, and the other is added on the 15th of the month or the next trading day.

Each “Buy” must meet the following criteria:

- ‘Strong Buy’ quant rating for at least 75 consecutive days

- A U.S. Common Stock (i.e. No ADRs)

- Not a REIT

- Has a 3-month average market capitalization greater than $500M

- Stock price greater than $10

- Has not been recommended in the past 1 year

In addition to the above criteria, the team seeks stocks that have a combination of:

- Value: Stocks that are considered undervalued compared to their intrinsic worth. These stocks trade for less than their actual or estimated earnings, dividends, sales, etc. Value investors look for bargains, believing the market has undervalued these stocks.

- Growth: Stocks with high potential for future revenue and earnings increases. These companies are expected to grow at an above-average rate compared to other stocks in the market. Growth investing involves more risk but also has the potential for higher returns.

- Profitability: Profitable companies are generally considered more stable and less risky to invest in. Metrics like return on equity (ROE), net margin, and earnings per share (EPS) are commonly used to measure profitability.

- Momentum: Refers to the tendency of a stock to continue moving in the direction of its current trend. Momentum investors capitalize on existing trends, buying stocks that are going up and selling those that are going down.

- Revised Forward-Looking Earnings Estimates: This term is a mouthful but super important. It means analysts have updated their earnings predictions for a company’s future. If estimates are revised upward, it’s often a bullish sign, indicating expected growth. On the flip side, downward revisions could signal trouble ahead.

So what the above tells me is that the team applies a combination of quantitative and fundamental analysis to identify investment opportunities.

Investment Thesis

Steve and his team then form an investment thesis for new recommendations using the above criteria.

As a subscriber, I could visit Alpha Pick’s homepage and find the investment thesis posted chronologically.

The investment thesis covers basics like an overview of the company, macro trends the company may benefit from, and an explanation of its business model.

Further down in the article, the team describes its buy thesis, explaining its rationale for the stock factor grades.

One cool differentiator I see is an analyst named Zackary replies to subscribers’ questions in the comment box, creating an engaging dialogue.

Selling Criteria

Subscribers are notified via email when the team closes out or reduces a position in the portfolio.

When a stock no longer scores well on fundamentals, valuation, and momentum relative to its sector, or if a stock is rated as ‘Hold’ for more than 180 days, it becomes a ‘Sell’ and is removed from the portfolio.

Alpha Picks sells the entire position in a stock if any of the following occur:

- The rating falls to “Sell” or “Strong Sell.”

- The company announces an M&A event in which it is the target, or it announces a merger of equals.

- The rating falls to “Hold” and remains a “Hold” for 180 consecutive days (as long as the stock is not a ‘winner’ – see below).

Alpha Picks’s “quant research” shows that their portfolio performs better when they let their winners “run.”

A stock is a ‘winner’ when it doubles from the price at which it was purchased. For ‘winners’, if the rating on the stock falls to ‘Hold’ and remains there for 180 consecutive days, the team will only sell the initial investment in the stock. They will keep the remainder of the position in the portfolio.

They only eliminate ‘winners’ if:

- Rating falls to “Sell” or “Strong Sell”

- Company announces an M&A event in which it is the target

- The company announces a merger of equals

Alpha Picks Team

The Alpha Picks team is small. It’s run by stock picker Steven Cress and a junior analyst, Zachary Marx.

Steven Cress

Steven Cress, a former hedge fund manager and senior quantitative trader at Morgan Stanley, makes stock picks.

According to his LinkedIn, it looks like Seeking Alpha purchased the company he founded, and that’s how he became associated with Seeking Alpha.

Zachary Marx, CFA

The Junior, who appears to be the only analyst on the team, is Zachary Marx. According to his LinkedIn, he has about 6 years of quantitative investing experience.

Best For

Alpha Pick’s buy and buy-and-hold approach to investing makes this stock-picking service ideal for long-term investors and those seeking long-term capital appreciation.

- Buy and hold investors.

- Investors seeking capital appreciation.

Given its broad market exposure, Alpha Picks is not ideal for income-oriented investors, day traders, or single-sector investors.

PROs and CONs Explained

Let’s explore the PROs and CONs of Alpha Picks a little more deeply.

PROs:

- Investment Team with Legit Pedigree: Senior Portfolio analyst Steve Cress has serious experience. He founded his own hedge fund and spent many years as a Senior trader at Morgan Stanley.

- Market Outperformance: The portfolio has outperformed the market 2.7X since inception. I calculated a weighted average beta of just 1.06, making its performance even more intriguing.

CONs

- Limited Track Record: Alpha Picks has only been around Since July 2022, so while their success is impressive, what really matters is providing investors with year-over-year returns.

- Requires familiarity with Rating Factors: Alpha Picks assumes you know the company’s rating factors and methodology, so if you aren’t, you’ll need to do some research after signing up.

Price and Value

Alpha Picks is $449 for the first year ($50 savings) off of the full price of $499.

For $449/year you get access to:

- 2 new stock picks per month/24 picks per year

- Monthly Portfolio Review Videos

- Complete Investment Thesis for Stock Picks

Best Alternatives

If you don’t fancy Alpha Picks by Seeking Alpha, don’t fret. There are several excellent alternatives.

1. Motley Fool Stock Advisor

- Why it Stands Out: The Motley Fool Stock Advisor shines with its specific stock recommendations, backed by detailed analysis and a strong track record of performance. This valuable feature aids investors of all levels to identify potential investment opportunities in the stock market. While Alpha Picks has had tremendous success, Motley Fool Stock Advisor has been around for many years, making spectacular bets on the largest tech stocks.

- Returns: +462% since inception

- Best For: Both novice and experienced investors who appreciate guidance on stock picks and investment strategies

- Pros: Provides specific stock recommendations, offers in-depth reports, and a solid track record of performance.

- Cons: Requires a subscription; not all recommended stocks may suit every investor.

- Price: $79/year

or read our complete Motley Fool Review.

2. CNBC Investing Club

- Why it Stands Out: The CNBC Investing Club is a subscription-based investing service that provides stock picks, portfolio analysis, and market analysis.

Jim Cramer created the Investing Club to help all investors build long-term wealth in the stock market. The CNBC Investing Club is now the official home of Jim Cramer’s Charitable Trust. - Returns: 21.9% between 2019 – 2023

- Best For: Active traders, Momentum-oriented traders

- Pros: real-time investment advice, monthly meetings with Jim Cramer, community engagement

- Cons: Some duplicate content found on CNBC, Price

- Price: Starts at $49.99/mo

- Current Promotions: None listed

or read our complete CNBC Investing Club Review.

Is Alpha Picks Worth it?

Alpha Pick’s impressive performance over the past year certainly presents a tempting opportunity for many investors.

However, considering the group has only been in action for a little over a year, I would tread cautiously if you think you will strike it rich with this investing group.

I am more of an index fund type of guy, so I even felt a little strange when I signed up for Alpha Picks, but I thought it could help expand my view.

For $40 a month, you’re not breaking the bank for a subscription; at worst, you’ll hopefully learn something new about investing.

Frequently Asked Questions

What’s the Difference Between Seeking Alpha Premium and Picks?

Alpha Picks is an investing group. If you sign up just for the investing group, you don’t have access to all other contributor-based articles. Meanwhile, if you have a Seeking Alpha Premium subscription, you have access to all articles and tools but not the investing group.

If you sign up for a Seeking Alpha Pro subscription, you have access to the Alpha Picks Investing Group and all the articles and tools Seeking Alpha has to offer.

Our Review Methodology

Investing in the right financial products is crucial for achieving your financial goals. That’s why our review methodology is designed to give you a comprehensive understanding of various investing platforms and tools. Here’s a breakdown of what we focus on:

Tools and Features

We dig deep into the suite of tools that each platform offers. Whether it’s automated investment features, tax optimization, or specialized charting tools, we evaluate how these features contribute to smarter investing decisions. We ask questions like:

- What is its main offering, and how does it compare to its peers?

- How effective are the risk assessment tools?

- Are there any value-added services like educational content?

Price and Value

Price matters, especially when it comes to investing, where every penny counts. We analyze:

- Subscription fees

- Hidden Charges

- Price compared to the overall value received

We’ll let you know if the platform gives you the most bang for your buck.

Ease of Use

User experience can make or break an investment platform. We assess:

- Interface Design – Is it intuitive and easy to use?

- Mobile app availability and functionality

- Customer Support – where applicable.

Nobody wants to navigate a clunky interface when dealing with their hard-earned money.

Stock Breakdown

Good investing is rooted in great research. We examine:

- The quality of stock analysis tools

- Returns on an absolute and comparative basis

- Availability of real-time data

- Depth of research reports

We check if the platform provides actionable insights to make informed decisions.

How We Do It

- Hands-On Testing: I signed up for Alpha Picks to actually provide real insight. This is how I give a unique perspective. We’re unlike some other sites where they simply rehash marketing materials.

- Customer Reviews: What are other users saying? We look at reviews and customer feedback to gauge public opinion.

- Comparative Analysis: Finally, we compare each platform against competitors in terms of features, pricing, and user experience.

We take a comprehensive approach so that you don’t have to.

By sticking to this methodology, we aim to guide you toward investment tools that align with your financial objectives. Happy investing!

Why You Should Trust Us

Our reviews are unbiased and data-driven. While we may receive a commission if you purchase a product through our link, it does not impact our editorial integrity. In addition, all articles are independently reviewed by individuals with extensive experience in investing and personal finance. Lastly, for further validation, we often refer to authoritative financial sources like Morningstar, The Wall Street Journal, and Kiplingers, to name a few.