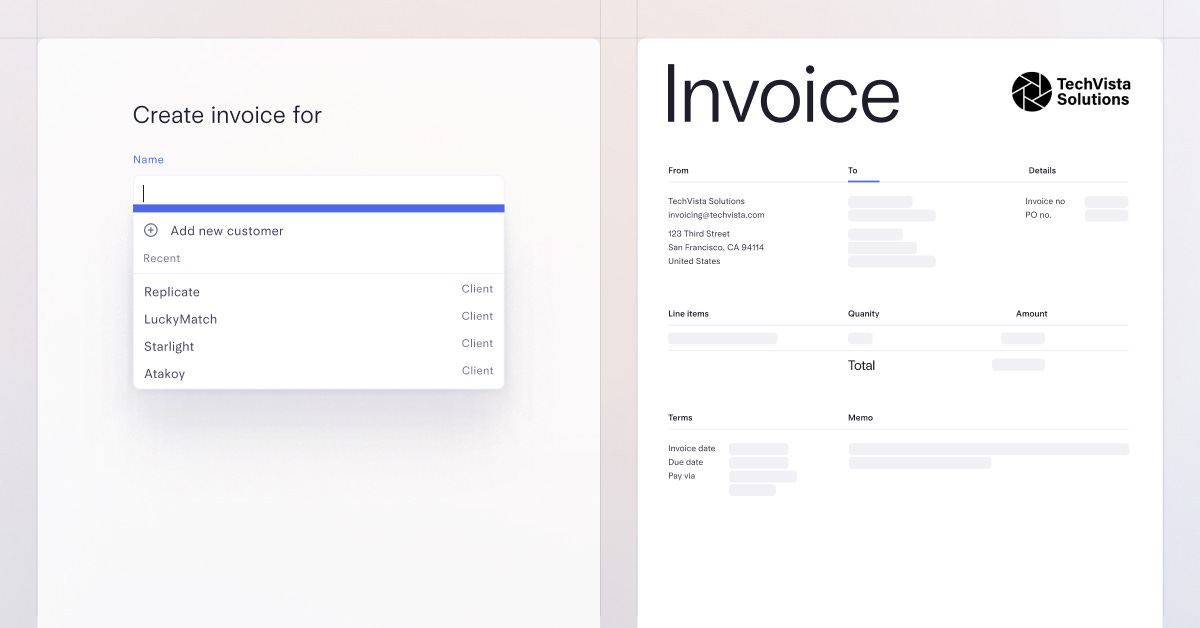

Mercury simplifies your financial operations by powering them from the one thing a business needs: a bank account.* And now, Mercury offers Invoicing so you can send invoices, track what you’re owed, and get paid the way you want — all in one place.

Customize your invoices by adding your logo and preferred color scheme, view who owes you what and take action from there, and get paid via credit card, Apple Pay, Google Pay, wires or ACH.

(And that’s good news… because while I won’t judge a book by its cover, as a SaaS CFO, I’m a bit of an invoice snob.)

*Mercury is a financial technology company, not a bank.

Banking services provided by Choice Financial Group and Evolve Bank & Trust; Members FDIC.

“OK. So we’re on Newbury Street, right? And you’re telling me all they sell is cupcakes? Just cupcakes? 2,000 square feet? 2,500? Let’s call it 2,500. Three employees a shift, running two shifts per day, six days a week? That’s a lot of fucking cupcakes. Wow, OK I put it at minimally 3,000 cupcakes per month, or 625 per day. And that’s just to out run their overhead… purely back of the envelope, of course…

You think the owner’s around?”

To the chagrin of my wife, that’s a one-way conversation that happens all too often. I can’t walk into a local bakery, car wash, or book store without making their P&L up in my head.

-

“How much does it take to run this joint???”

-

“An entire store in the mall that just sells hot sauce?”

-

“I bet they make 70% profit margin on these taquitos”

Every business, whether a small vendor at a local fair or a global enterprise, faces the challenge of covering its overhead— the fixed costs that need to be paid before the business enters variable cost territory and starts seeing a real profit. For many, there’s a point in the month or quarter where they “outrun” their overhead, and each subsequent sale becomes pure contribution to profit. Every period the clock resets, and it’s a race to get to your unique inflection point, and push to accelerate sales once you get there.

My dad was a physical therapist growing up. He owned a practice where they made, on average, $50 per patient that came in. He had multiple PTs, front desk workers, and a business manager (all fixed salaries). And then he had to pay rent on the locations.

He knew that, on average, at 1,100 visits a week they broke even, and at 1,200 was where the real money was made. Once you were in that territory, there were a lot more dollars dropping to the bottom line.

Given that he, the owner, would pay himself from the profits left over, I would hear him talk about how it was a 20% net operating margin business if all went well. And he only had so many at bats to make money in a given month, depending on how the calendar shook out. On average there are 22.2 business days in a month, factoring in partial days for the impact of holidays and weekends. That’s basically your revenue capacity if you are in a service business. And similar to a boat leaving the shore with only half their passengers on it, if you don’t treat someone that day, you miss that revenue forever.

I remember there was this one TERRIBLE winter growing up. Snow days galore for multiple weeks. While kids were celebrating school cancellations, service business owners like my dad were sweating the impact on contribution margin. Cancellations from patients were rolling in left and right, as people either couldn’t get there due to the weather, or now had to watch their kids. The business was suddenly struggling to reach 900 visits per week, putting them deep in the red. For a 20% margin business, four snow days was a death sentence; it was literally 20% of his revenue capacity, and therefore all his profit.

I recently took a trip to the Minnesota State Fair. Being the sicko I am, I downloaded the vendor application online. I noticed “fried SPAM” and “fried Oreo” vendors were juggling fixed AND variable costs. They had to pay an upfront fee to secure booth space, representing a fixed cost, and they also paid a variable percentage on all their sales to the fair grounds. The turkey leg vendor explained how he thought about their sales in two stages: first covering the booth fee, and then maximizing profits for the rest of the event once that overhead was paid off. This mindset perfectly encapsulates the idea of “outrunning your overhead.”

Each business owner has quick rules of thumb to figure out when they go from being in the red to black.

For instance, I was speaking to someone who owned multiple auto mechanic shops. He looked at his revenue capacity by bay in the garage. Based on the fixed cost per mechanic to run it, and the allocated overhead for rent and the front desk worker, plus the shit they kept around the shop like towels and oil filters, he knew that after the lift had serviced, on average, 70 cars that month, he was making money. He even showed me the accounting software on his phone, which detailed the number of jobs done that day, lift utilization, and total billings.

I asked why he didn’t look at it based on days – if it’s a 40% margin business, why didn’t he say “on the 14th business day of the month, I’m in the clear”?

He explained the unique seasonality of the industry, where demand for getting cars fixed varied widely. Demand peaked in April, when people received their IRS refunds in the mail, sprinting in to get their squeaky brake pads fixed which had been delayed for so long. And business slowed down materially in January and February when people were paying off holiday credit card bills. Not all days were created equal; therefore, days would be a poor pacing heuristic for outrunning overhead.

And there are always hidden variables in every business in terms of what could go wrong when it comes to getting paid – like snow days.

-

Will the apples being delivered to the bakery go bad?

-

Will the high school kid not show up to work the fried dough booth at the fair, decreasing our capacity to serve?

-

Will the auto shop’s lift break and leave us with two bays instead of three?

And another quirk that any business owner intimately tied to the heartbeat of cash flows knows – the dreaded triple payroll months – there are 26 payrolls per year, so 2 months of the year have 3 payrolls instead of 2.

I realize these are not overly scientific ways to size up your business.

I’m not winning a Turing award for my work in fixed vs variable costs. But I do think this type of thinking forces any business owner, or finance professional, to better understand the unique rhythms of their business, and know if they are pacing for a good month or bad month before the period closes and the accountants dig in.

Yes, we will always close the books at the end of the month and check the official X’s and O’s. But in period I want to be as close to the pulse of the business as I can, and sometimes that lends itself to relying upon equations predicated on daily cupcake velocity.

As my dad says:

“I took calculus, I took geometry, but all you really need to run a business is add and subtract. A lot or rich people got there from adding and subtracting. It’s not complicated.”

He’s right – I ramble on about complicated metrics like LTV to CAC and Net Dollar Retention Rate each week. Sometimes it’s nice to remember that good business is simply making more money than you spend in any given period.

Are there any unique ways you look at outrunning your overhead? And do you do anything differently when you get there? Sound off in the comments.

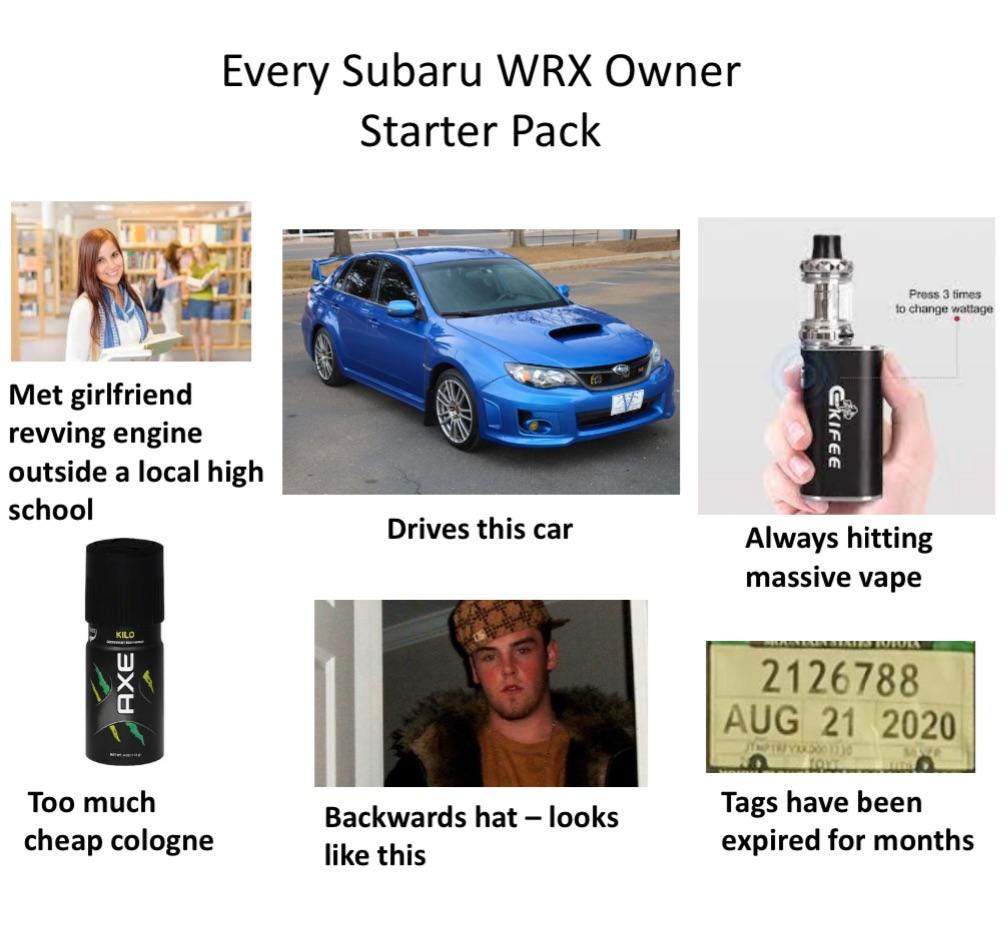

I asked my local car wash owner about the percentage of customers on membership plans vs one time washes. I noticed most car washes set the membership breakeven to the end user at 2.5 washes per month. He said it’s the Planet Fitness model, where they hope you don’t show up, as the water bill is actually the most expensive cost of doing business. This has gotten much better over the last ten years with the advent of car wash technology that allows you to recycle the water over time. But it’s still a big variable cost.

He explained that he tries to price memberships where the recurring cash flows cover his overhead. Approximately 35% of his customers on a given day were members. And on average, they didn’t hit the 2.5 mark every month.

Well, except for a few power users, who he said were ALSO consistently on the cheapest plans. They, of course, came in every day, and were a drag on the business.

“Like that asshole in the 2011 Subaru WRX. He pays $15 dollars a month, and rolls through here every morning. Can’t stand that guy. Plus, that muffler sounds like a wet fart.”

I interviewed Tony Boor, CFO of Blackbaud, a leading software company supporting nonprofits and institutions across various sectors. Blackbaud generated over $1.1 billion in revenue last year and is one of the most valuable vertical software companies around. We covered:

-

Capital efficiency metrics

-

The company’s “layer cake strategy”

-

How to incorporate payments into your product

Thesis Driven covers the trends and topics driving the future of real estate, from new technologies to financing models to real estate sectors. Subscribers get 2-3 exclusive deep dives per week from writers covering categories including residential, office, industrial, and more. By focusing on macro trends and long-term opportunities, Thesis Driven is relevant for anyone looking to get smart on the real estate industry and the role of real estate in our economy.

Friends of Mostly Metrics can get 25% off forever below.