Fintech Report | Oct 16, 2024

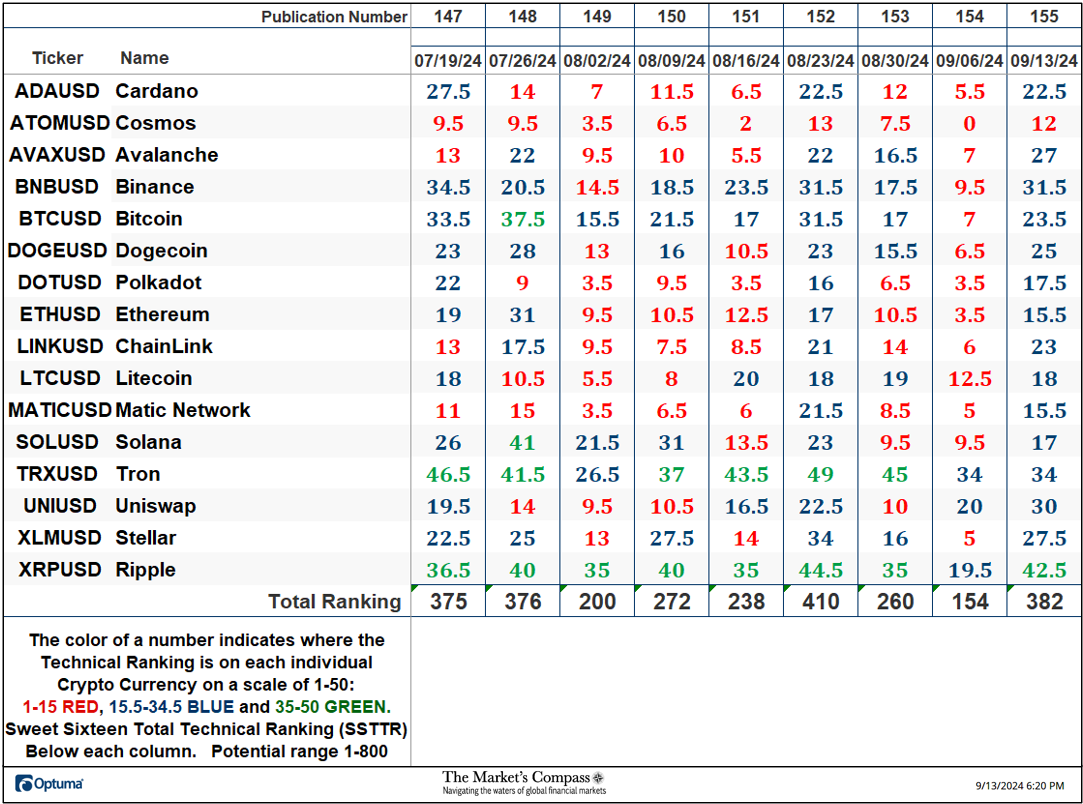

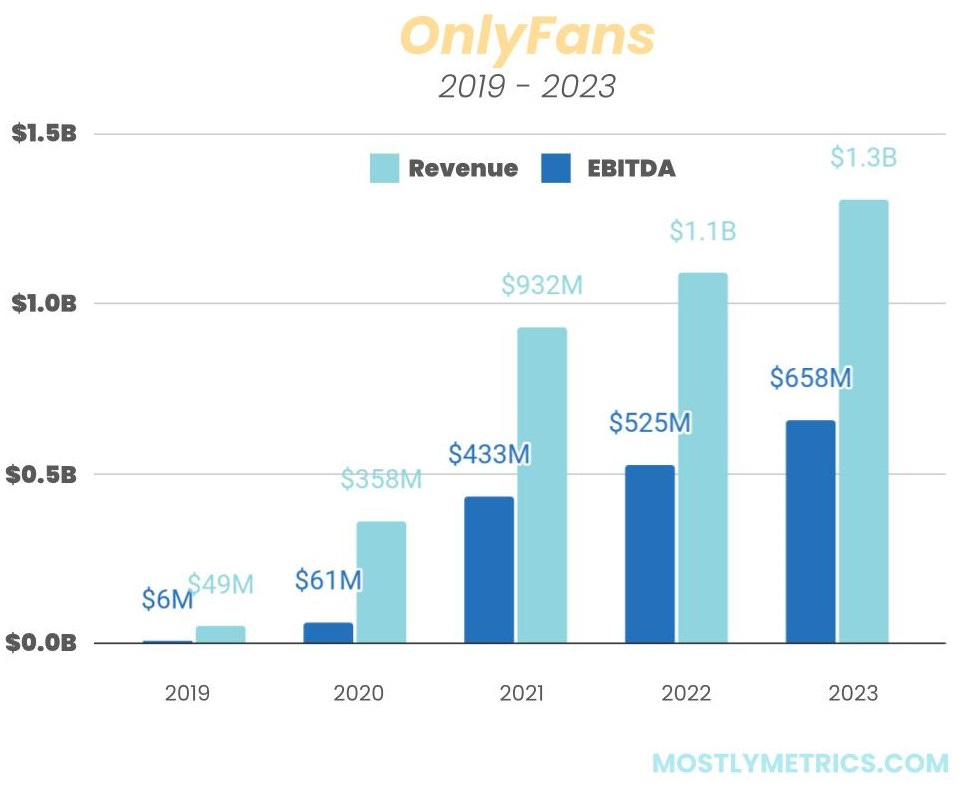

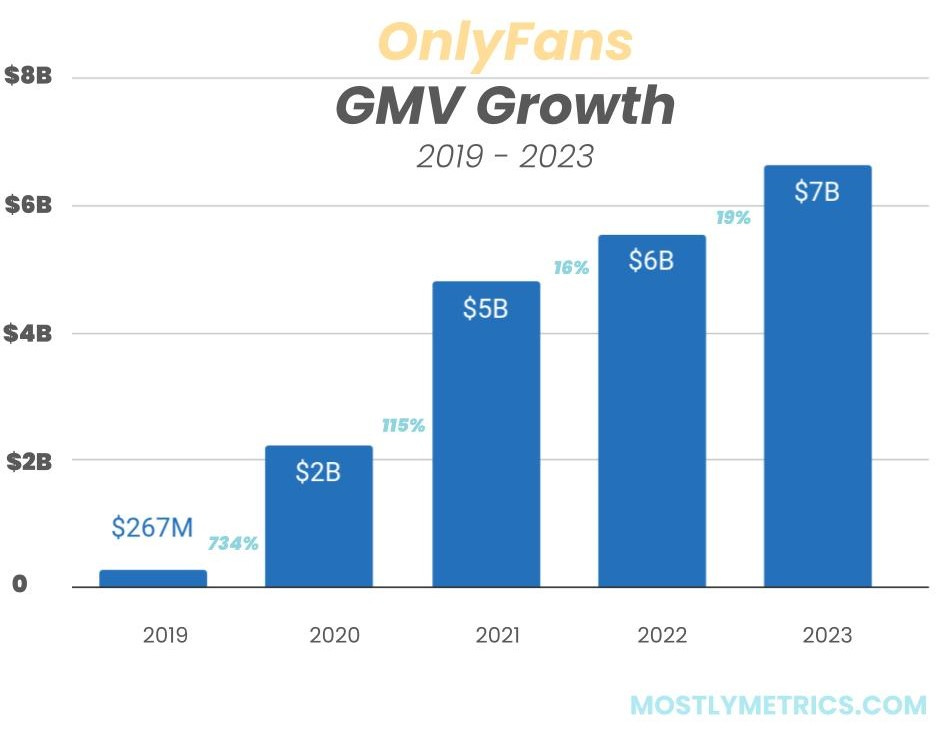

Image: State of European Fintech 2024 (Finch Capital)

Image: State of European Fintech 2024 (Finch Capital)

Finch Capital’s 2024 report reveals a shift in Euopean fintech towards profitability, sustainable growth, and strategic M&A

European fintech in 2024 is about consistent financial gains over rapid expansion. Fintech Capital released the 9th edition of the “State of European Fintech 2024” (37 page PDF) lifting the veil on recent market developments and adjustments to investment thesis’ that are influencing this sector, such as the dominance of the UK, the role of AI and digital currencies, and the resurgence of digital banks. This post looks to highlight the key trends and insights that matter to fintechs and investors.

1. Current State of Fintech in Europe (2024)

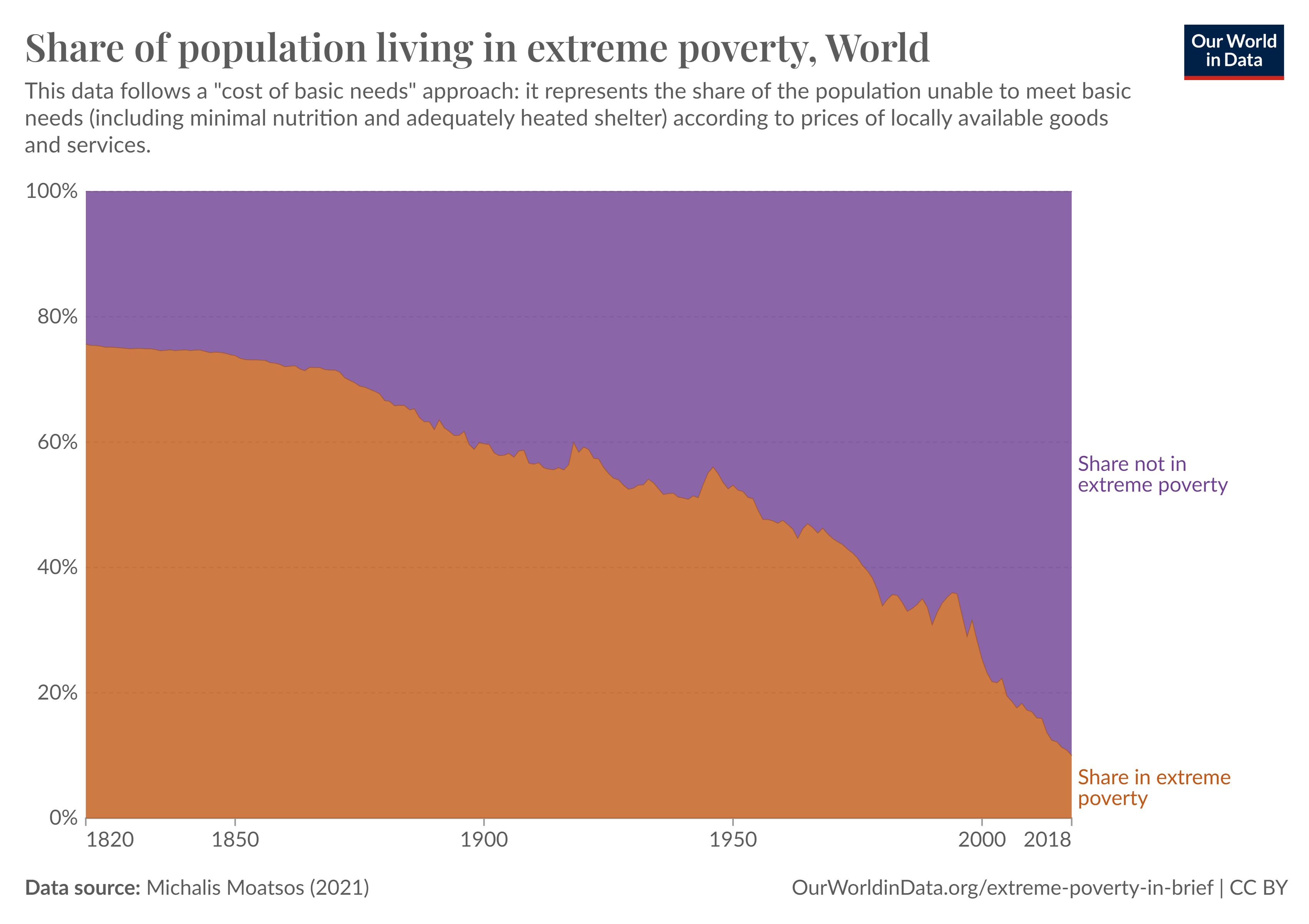

- European fintech funding fell 25% in 2024 compared to last year.

- Despite challenges there are signs of recovery especially in mid-sized mergers and acquisitions (M&A).

- Companies are focusing more on more consistent profits instead of fast growth.

- Sustainable business models are preferred now instead of chasing high valuations.

- The UK leads the market, receiving 65% of the total fintech funding.

- Other regions like the Nordics and the Netherlands are maintaining stability despite the overall downturn.

2. Funding and Market Insights

- In the first half of 2024, total fintech investments reached €2.9 billion across 443 deals, down from €3.8 billion and 548 deals in the same period of 2023.

- Investors are being more selective, prioritizing companies with clear paths to profitability.

- Large late-stage investments have decreased while smaller more sustainable rounds are rising.

- Higher interest rates have boosted challenger bank profits, and fintechs with deposits.

- There’s early stage interest for crypto and digital assets (especially stablecoins) as they challenge traditional banking models although the market continues to be volatile.

See: DLA Piper’s Tech Index 2024 – Highlights for Fintechs

- Insurers have embraced AI to streamline operations, with over 80% utilizing AI in underwriting and risk assessment. This insurtech trend points to increased efficiency and reduced operational costs.

- Deals in the mid-sized segment (under €500 million) have increased, making up 32% of the global market for such deals. This is similar to the U.S. in terms of volume but smaller for larger transactions.

- Companies with higher profit margins (EBITDA) are valued more with some seeing valuations over 10 times their earnings.

- The payments sector is seeing more mergers aimed at boosting efficiency. Buy Now, Pay Later (BNPL) is making a comeback, thanks to better risk management powered by AI.

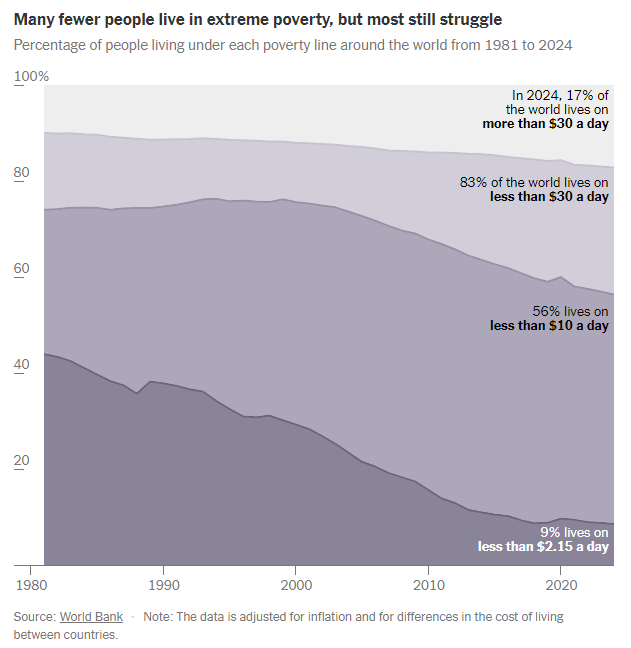

3. Geographic Insights

- The UK is attracting 65% of Europe’s fintech investment and has a strong M&A market driven by a focus on profitability.

- Nordics and Netherlands remain steady despite economic challenges, with consistent funding and a focus on profitable, mature companies.

See: How Fintechs Are Unlocking Value in Private Markets 2024

- Government support in Ireland and Germany is nurturing tech startups, so possible growth rebound in 2025.

- Poland has a vibrant early-stage investment scene but lacks the follow-up funding needed for companies to scale up in later stages (Series A and B).

Key Takeaways

- The mid-sized M&A market in Europe offers stable returns, so an interesting time for Canadian venture funds to explore deals in the UK and Nordics?

- Increasing use of AI in insurance and banking creates opportunities for Canadian fintechs with AI expertise to enter the European market.

- The focus on sustainable business models and B2B solutions aligns well with a longer term investment approach. Germany and the Netherlands have strong government support, which may be attractive for Canadian investors.

European Fintech Outlook in 2024

European fintech in 2024 is all about stability and consistent growth. Finch Capital’s latest report shows that the focus has shifted from grow at all costs expansion to more sustainable models and profits. For more perspective, check out Chris Skinner’s post here.

See: Global Fintech Funding Sees a Boost in Q2 2024

Although the UK remains the leader (65% of investments), government support in the Nordics and Germany may create a good time to explore AI and mid market M&A in Europe for Canadian investors.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org