Today’s post is a deep dive into building a multi year operating model, which many people call a Long Range Plan (LRP).

Here’s what we’ll cover so you can build one yourself:

-

Chapter 1: Introduction to Long-Range Planning

-

Chapter 2: Laying the Foundation

-

Chapter 3: Modeling Sales Capacity

-

Chapter 4: Modeling Labor Costs

-

Chapter 5: Structuring Non-Payroll Expenses

-

Chapter 6: New Customer Acquisition

-

Chapter 7: Existing Customer Retention & Expansion

-

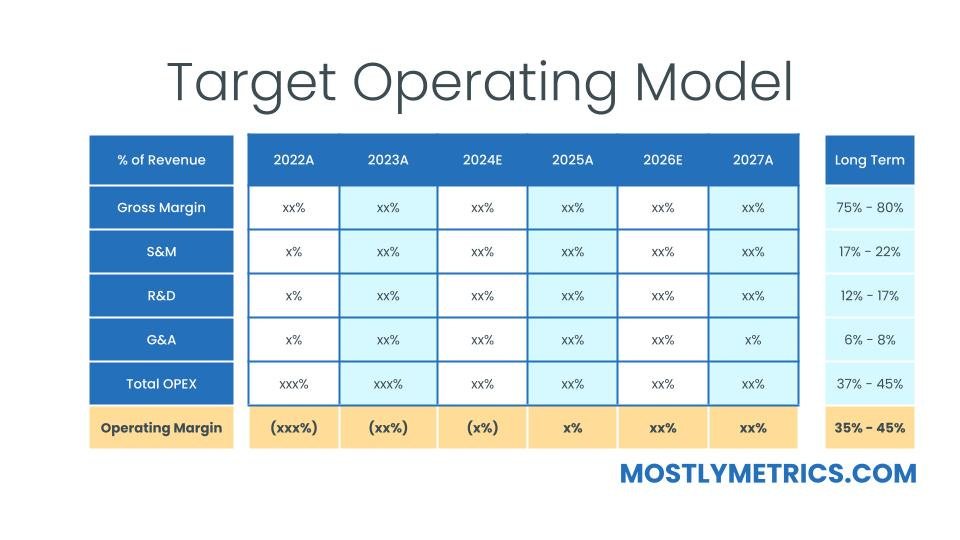

Chapter 8: Operating Margins and Cash Flows

-

Chapter 10: The Role of Benchmarks

A long-range plan (LRP) bridges the current year’s tactics to longer-term business objectives. It confirms and supports investor expectations. The goal is to progress the company along two critical dimensions:

-

Revenue Durability: Prove customers can be acquired at a predictable cost, retained, and expanded over their lifecycle.

-

Free Cash Flow Sustainability: The company reaches a point where it no longer relies on external capital, and has thought through where profits will go (i.e., reinvest for growth, distribute to shareholders, etc.)

Long-range planning is an exercise in resource allocation across several years. It marches the company towards what “good” looks like at “scale”, however you define both of those characteristics in the context of the industry you play in.

While annual planning is more granular and focused on specific targets for the next 12 months, long-range planning is about setting directional goals for the business that arrive at a target financial profile over time. It’s more strategic, requiring a marriage of top-down industry forecasts with bottom-up operational realities.

Long-range planning also forces companies to consider the full product lifecycle, from roadmap development to monetization. It’s not just about optimizing current products but also forecasting when new products will hit the market, estimating both their costs and revenues.

While in an annual operating plan you forecast at the general ledger (GL) level and by vendor names (e.g.,. Salesforce, Gong, NetSuite), you can theoretically build a solid LRP by concentrating on go to market resources, GTM output, and grossing up the remaining non payroll items using a set of basic assumptions.

Why is that possible?

70% to 80% of software company expenses are people related. 10% to 20% are hosting and infrastructure. And the remaining bits and pieces are nonpayroll, like rent and travel. Most of the juice is in the people bucket, and much of the rest can be rolled forward within a relatively high degree of accuracy, especially if the underlying assumptions are linked to said headcount growth.

The type of LRP you build will be based on:

-

The current state of financial maturity at your company

-

The specific questions you are trying to answer at that point in time

-

How much time you are willing to spend on it

To drill into the last point – you can always go deeper and take longer to turn the screws; but the real question is what you’ll be using this model for. That should dictate the LRP’s dimensionality (HardMode by Thomas Robb).

It’s common to have one core LRP the org relies on for board purposes, and to “version up” on an ad hoc basis when you need to stress test what doing [xyz] would look like. Remember – we’re designing a tool for longer term decision making; not a statue for the Louvre.

The biggest thing I try to focus on, since revenue growth is the most important, is giving as much detail as possible to the go to market (GTM) side of the house. If there is an area I want to spend more time on, I push to add more information on sales capacity:

GTM resources not only dictate the company’s revenue capacity for future years, they also make up more than 50% of headcount costs. So getting your GTM modeling right, including productivity and cost, determines your LRPs strategic value.

Building a strong LRP starts with defining your key assumptions. Typical assumptions might be:

-

We will launch one new product per year.

-

We’ll rely on areas outside the US to make up 25% or more of our revenue at some point

-

We’d like to capture 10% of our total addressable market (TAM)

-

We strive to achieve positive cash flows within the next 24 months

-

We must maintain a revenue growth endurance score of 70% or more

-

We will ensure our ARR per head is top quartile, based on benchmarks

The FP&A or Strategic Finance team should maintain an “assumptions log,” revisiting and revising it over time to ensure the objectives and assumptions evolve with the business.

As we mentioned, this is where the rubber hits the road. Ensure you plan for the following:

.png?width=1200&name=MicrosoftTeams-image%20(11).png&w=696&resize=696,0&ssl=1)

.png?width=1200&name=MicrosoftTeams-image%20(11).png)