The Market’s Compass US Index and Sector ETF Study

Welcome to The Market’s Compass US Index and Sector ETF Study, Week #507. As always it highlights the technical changes of the 30 US Index and Sector ETFs that I track on a weekly basis and normally publish every third week. Past publications can be accessed by paid subscribers via The Market’s Compass Substack Blog.

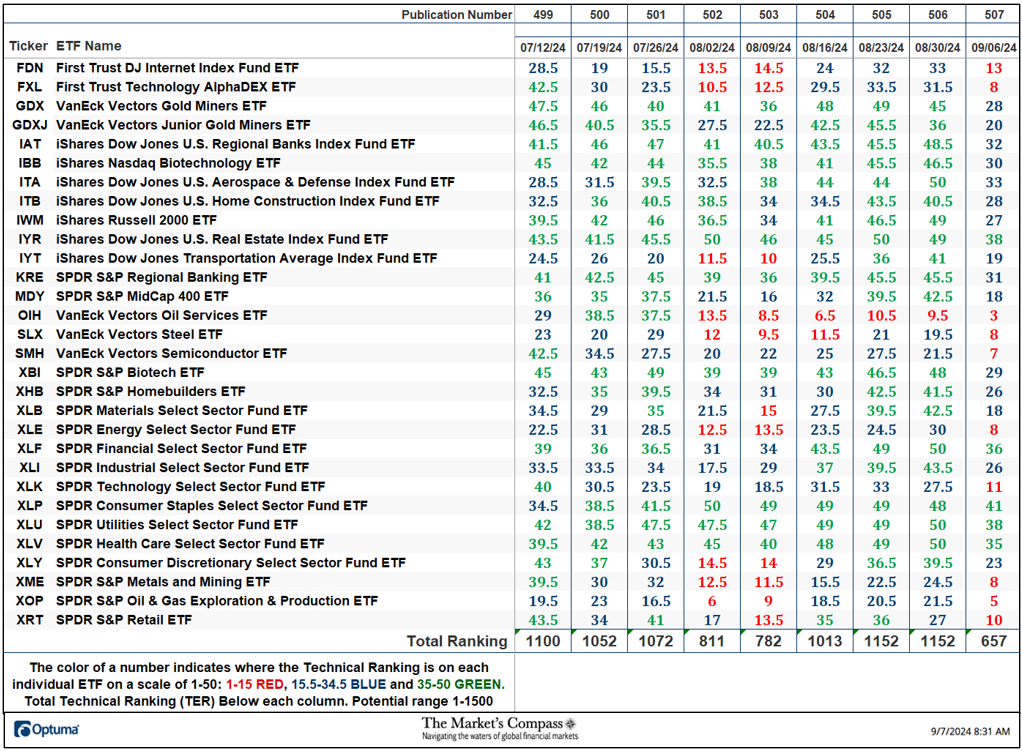

The Excel spreadsheet below indicates…

Raytheon agrees to massive $252M settlement over federal bribery charges

RTX Corporation, the defense contractor formerly known as Raytheon, has agreed to pay the U.S. government $252 million to resolve criminal charges alleging it paid bribes to secure contracts with Qatar, federal prosecutors said Wednesday.

The company entered into a deferred prosecution agreement on charges of violating the anti-bribery provision of the Foreign Corruption Practices Act and the Arms Export Control Act. The company also has agreed to forfeit $36.6 million.

At a brief hearing in federal court in Brooklyn, lawyers for RTX waived their right to an indictment and pleaded not guilty to both counts. They did not object to any of the allegations in court documents filed in conjunction with the agreement.

Under the agreement, the company will have to demonstrate good conduct for the next 3½ years and foster a culture of ethics and compliance with anti-corruption laws.

According to court documents, Raytheon employees and agents offered and paid bribes to a foreign official between 2012 and 2016 to gain an advantage in obtaining lucrative business deals with the Qatar Emiri Air Force and Qatar Armed Forces.

The company then succeeded in securing four additions to an existing contract with the Gulf Cooperation Council — a regional union of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates — and a $510 million sole-sourced contract to build a joint- operations center for the Qatari military, the court documents said.

Raytheon made about $36.7 million in profit from the Gulf Cooperation Council contract additions and anticipated making more than $72 million on the joint operations center, but the Qatari government ultimately did not go forward with the deal, prosecutors said.

The Slippery Slope of BRRRR—Is It Still the Best Way to Run Your Landlording Business?

With median home prices over $430,000 and interest rates hovering around 6%, the concept of BRRRRing your way to financial freedom seems like a real estate strategy from a bygone era.

The BRRRR strategy (buy, rehab, rent, refinance, repeat) is based on finding discounted properties, fixing them up, renting them out, refinancing, and socking away the cash flow with a long-term tenant, and repeating the process until you have amassed a sizable monthly cash flow. In 2024, I largely believe that it’s unrealistic to achieve.

Assuming you can find a discounted home, fix it up using hard money, and get market rent, the issue comes when you have to refinance it, strip the home of its equity, and take on more debt to repeat the process. Now, you are on the hook for the extra loan.

How much cash flow are you really making? Assuming you want to follow the 1% rule, you would have to charge your tenants over $4,000/month in rent if you purchased your rental below the median market value, adding debt to bring it to the median price when you rehabbed and refinanced. This is not feasible in most markets because the average national U.S. rent is $1,840.

Low-Cash-Flowing Properties Are Not Worth It

For argument’s sake, let’s assume you have found an investment that meets all the BRRRR criteria and cash flows $300/month after all expenses. It’s time to break the fallacy that you can BRRRR your way to financial freedom by amassing $300 cash-flowing rentals.

First, in the current market, to find a property that cash flows by $300 and does not cost a fortune, you would have to be in a C or C+ neighborhood—or worse. Having owned many such properties and clocked in more landlord/tenant court hours than some judges, I can attest that the numbers on paper never work out. Repairs and nonpayment of rent/evictions wipe out any perceived cash flow and leave most landlords deeply in the red. Even if you have scaled a few properties generating $300/month in cash flow, one costly repair or eviction could crash your real estate house of cards.

Buying in better neighborhoods costs more money. Are you really going to spend well over half a million dollars to break even, or cash flow $300-$500/month? You would need to be financially free to make such a move and look for a place to park cash or enjoy depreciation while gaining appreciation. Cash flow would not be your primary goal.

Alternative Strategies

Before you throw your hands up in the air in despair, wondering if owning rental real estate is even possible or worth it today, don’t fret. Making money from rentals is still possible, but the BRRRR method using a yearly lease is not the way. You need to be creative. Here are a few alternatives to consider.

Short-term/medium-term/vacation rentals

To cash flow, you need to increase rents. Assuming you cannot convert attics or basements to extra bedrooms, the easiest solution is not to rent your apartment/house on a standard yearly lease but instead convert it to a short-term/medium-term or vacation rental. Much of this depends on whether there is demand for this type of use in your area and whether you are prepared to undertake the additional management and costs this incurs or hire someone who is.

If you are in a seasonal location, when the rents for 12 months are collated, it might not be worth it. However, it could be a good move if you are in an in-demand college town or tourist area.

Buy a fixer-upper and do the renovation yourself

Sweat equity costs you nothing but time and materials. Assuming you have access to both, and you buy a property cheaply enough, you could circumvent a costly renovation and thus keep the equity in your investment. The end result is greater cash flow.

Rent by the room

The affordability crunch has made by-the-room rentals more popular in recent years. Whether you wish to call them workforce housing or co-living spaces, the concept of having roommates is not new. However, this type of rental can generate far more income than a standard whole-house rental, especially when each room is updated to feel luxurious like a hotel room.

Save money from your job and make large down payments

This might fly in the face of why many people want to invest in real estate, but the importance and benefits of a good-paying W2 job cannot be overstated. Your job is your first business partner and, as such, will help you scale much faster than risky leveraging, crossing your fingers, and hoping your tenants pay their rents on time.

If you are not in a position to borrow safely, don’t. Instead, focus on earning as much money as you can from your 9-to-5, limiting your expenses, and buying houses traditionally, never refinancing and stripping equity but ensuring your properties cash flow well by putting enough of a down payment each time.

Start by flipping houses to build up a sizable nest egg

Flipping houses is easier said than done. If you embark on this venture without a trusted team in place, it can amount to a full-time job. However, when done correctly, it can provide a big chunk of cash, which you can then deploy as a sizable down payment for rental property.

Invest in multifamily housing

If single-family real estate doesn’t cash flow, why should a multiunit be used? Economy of scale. A 20-unit rental, with each unit generating $300 in cash flow, will generate $6,000/month.

Of course, the multiunit will cost a lot more upfront than a single-family house. However, that can also be an advantage because, generally speaking, the competition is lower amongst buyers for multiunit properties. There is more opportunity to “buy right” (at a price that makes sense economically), especially if the building needs work. You can add value—thus increasing the rental income and asset value. There is also more scope to bring on partners, as there is more cash flow.

HUD offers programs that apply to small multifamily buildings in multifamily housing projects in urban renewal areas, code enforcement areas, and other areas where local governments have undertaken designated revitalization activities.

Other types of commercial buildings

Despite the drop in interest rates, commercial real estate will still face a tumultuous 2025, according to analysts. Particularly troubled is office space. Depending on your funding and investment ability, converting offices to housing is ripe for opportunity, with historic state and federal tax credits available for investors. Many states have also changed zoning laws to facilitate the process.

Final Thoughts

The BRRRR method using a yearly lease strategy had its time, but modern-day economics just don’t support it. It might become fashionable again should interest rates drop precipitously and housing prices and rents align. However, if investors attempt to BRRRR with less-expensive houses by marginal cash flow amounts in today’s market, they could be setting themselves up for financial ruin.

In the best of times, real estate investing is not for the fainthearted. There are many moving parts, each of which could derail you. This is exacerbated when adopting a highly leveraged investment strategy.

Be sensible. The risk and stress of investing a few hundred dollars in cash flow isn’t worth it. Just because banks might lend you money based on your credit score or the value of your asset doesn’t mean you should take it.

Find the Hottest Deals of 2024!

Uncover prime deals in today’s market with the brand new Deal Finder created just for investors like you! Snag great deals FAST with custom buy boxes, comprehensive property insights, and property projections.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Mid-Semester Check-In

Intern Dispatches

Kalob McConnell here, checking in mid-semester. Here’s a bit of information about the projects I have been working on with the underwriters and support staff at Bigfoot Insurance.

Garage & Dealers

I’ve been working closely with Alysa and Karina to update the latest version of the Garage & Dealers application. We worked on clarifying some of the questions and making it a simpler submission experience for the agents.

All Other

10 Things You Didn’t Know about….

-

Homeowners as told by Adriana Oregon

-

Tiny Homes as told by Saaya Boling

-

Management Liability as told by Heather Gilginas

-

Workers’ Compensation as told by Amanda Seifert

-

Inland Marine as told by Fara Schnurr

-

General Liability as told by Jimmy Pacyna

-

Garage & Dealers as told by Alysa Wiggins

The Customer Support Team lead by VP Heidi Feist fields a ton of questions from agents across the country. We are licensed in all 50 states but not all carriers have markets there so there are significant variables when answering appetite questions. The best advice I can give agents is if an application doesn’t fit the main options, you can always submit those trickier ones to the All Other application.

Commercial Package

I worked on building the commercial package application. This helps agents with filling out Acord 125, 126, and 140. It will also be a great supplement for when other applications need Acords to be filled out.

Disaster

I am currently finishing up on the disaster application. I built in an additional underwriting questions section, which will help both agents and our underwriters. I helped clarify some of the questions throughout the application and have been working with Saaya to ensure that it is completely satisfactory. When finished, it will make it much easier for agents to submit applications and quickly receive quotes.

Experiences

So far, my internship has allowed me to cover a very wide range of responsibilities. My first couple of days I worked on writing a blog post and scouring their website for what could be changed or improved. I reached out to many people within the company with questions about their job and their responsibilities. This allowed me to experience and develop understanding for many different parts of their business.

Since starting, I have attended many different meetings with different underwriting groups within the company, marketing teams, and insurance agents. I have worked on several different analytical projects within Excel to help them with organizing agent data and in developing a quantitative understanding of which products are selling fastest and which products sell the least. I have assisted in developing marketing material for the company (Instagram posts, blog posts, and writing the newsletter). The major project I am working on now is developing and mapping disaster forms onto an online application.

I have learned so much about the industry and about what life would be like working for Bigfoot Insurance. I learn new information every day and am constantly exposed to exciting new experiences.

“I love insurance because it impacts everyone and is applicable to everyday life. It was a great first week on the job and I look forward to learning more about all the different aspects of the industry, developing skills from hands-on experience, and choosing my future career path. ”

Questions? Email our Customer Success Team or check out our FAQs on Zendesk!

Stay connected: LinkedIn | Twitter | Facebook | Instagram | YouTube |Blog | Bigfoot Staff

Tax Credits And Tax Deductions For 529 Plan Contributions

Source: The College Investor

One of the big perks of using a 529 plan to save for college is that many states offer a tax deduction for 529 plan contributions. Other states offer tax credits, and some even will allow contributions to any state’s plan (this is called tax parity) But, like anything, there are rules that apply.

Some states require you to contribute to their state’s plan, while other states allow you to take the tax deduction for contributions to any state’s plan. Finally, there are (sadly) states that don’t offer any incentives for contributions.

Also, the rules for withdraw can also impact your taxes. Make sure you understand the differences in qualified 529 plan withdrawals so you aren’t paying taxes and penalties!

What Is a 529 Plan?

A 529 plan allows you to contribute money for educational use. The funds must be used for education, which includes college or K–12 tuition.

The owner of the account remains in control of the account, while the money is used for a beneficiary (typically the child). This is different from a UGMA or UTMA account, which allows the beneficiary to take control of the account once they reach legal age.

Related: What Is A 529 Plan?

What Is the 529 Plan Contribution Tax Deduction?

Many 529 plans do offer state tax deductions on contributions. Some states even offer a tax credit. But not every state offers the deduction. Plus, there are certain rules you need to follow.

For example, most states only give you the tax credit or tax deduction if you contribute to your state’s plan. However, a few states offer “parity”, meaning the allow you to get a tax deduction regardless of which state’s plan you contribute to.

529 plans do not offer federal contribution tax deductions.

How Do I Open an Account?

You can open a 529 plan with your brokerage or by searching for 529 plans. Once you find one you like, you’ll choose an in-state or out-of-state plan. After the account is opened, you can then choose one of the investment options offered by the plan.

Check out this list here and see where to open the 529 plan that makes the most sense for you:

529 Tax Benefits by State

For most states, you must contribute to your state’s 529 plan (as opposed to an out-of-state plan) to receive any state tax benefit. However, seven states offer tax parity, which allows you to contribute to any 529 state plans.

529 Tax Parity States

These seven states that provide a tax deduction for contributions to any state plan include:

- Arizona: $2,000 single or head of household, and $4,000 for joint filers

- Arkansas: $5,000 for single filers, and $10,000 for married filers

- Kansas: $3,000 for single filers, and $6,000 for married filers

- Minnesota: $1,500 for single filers, and $3,000 for married filers

- Missouri: $8,000 for single filers, and $16,000 for joint filers

- Montana: $3,000 for single filers, and $6,000 for joint filers

- Pennsylvania: $16,000 for single filers, and $32,000 for joint filers

529 Plan Tax Deduction States

The following states offer deductions:

- Alabama: $5,000 for single filers, and $10,000 for joint filers

- Colorado: $20,000 for single filers, and $30,000 for married filers

- Connecticut: $5,000 for single filers, and $10,000 for married filers

- Delaware: $1,000 for single filers, and $2,000 for joint filers

- Georgia: $4,000 for single filers, and $8,000 for joint filers

- Idaho: $6,000 for single filers, and $12,000 for joint filers

- Illinois: $10,000 for single filers, and $20,000 for joint filers

- Iowa: $3,522 for single filers, and $7,044 for joint filers

- Louisiana: $2,400 for single filers, and $4,800 for joint filers

- Maryland: $2,500 for single filers, and $5,000 for joint filers

- Massachusetts: $1,000 for single filers, and $2,000 for joint filers

- Michigan: $5,000 for single filers, and $10,000 for joint filers

- Mississippi: $10,000 for single filers, and $20,000 for joint filers

- Nebraska: $10,000 for single and married filers, $5,000 if filing separate

- New Jersey: $10,000 per taxpayer, per year

- New Mexico: Full amount of contribution with no limit

- New York: $5,000 for single filers, and $10,000 for joint filers

- North Dakota: $5,000 for single filers, and $10,000 for joint filers

- Ohio: $4,000 per year regardless of filing status

- Oklahoma: $10,000 for single filers, and $20,000 for joint filers

- Rhode Island: $500 for single filers, and $1,000 for joint filers

- South Carolina: Full amount of contribution

- Virginia: $4,000 per year regardless of filing status

- Washington, D.C.: $4,000 for single filers, and $8,000 for joint filers

- West Virginia: Full amount of contribution

- Wisconsin: $3,860 per dependent beneficiary, self or grandchild

529 Plan Tax Credit States

The following states offer tax credits:

- Indiana: 20% tax credit on contributions up to $5,000

- Oregon: $150 for single filers, $300 for joint filers

- Utah: 4.95% of contribution, up to $105.44 for single filers, and $210.87 for married filers

- Vermont: 10% tax credit, up to $250 for single filers, and $500 for married filers

No 529 Plan Tax Benefit States

If your state has no income tax, the 529 plan tax deduction doesn’t apply. These states include:

Some states do have income taxes but no 529 plan tax deduction. They include:

Find your state in our full 529 plan guide here >>

Is It Worth It?

If you want control over the money you’re putting toward a beneficiary’s college tuition, then yes — it is worth it. Be sure the funds will eventually be used for education. If not, you’ll incur a 10% penalty, plus you’ll be taxed at your ordinary income tax rate for non-educational use of the funds.

Shopify: More Upside Ahead, But Look For Exits Soon (Rating Downgrade) (NYSE:SHOP)

With combined experience of covering technology companies on Wall Street and working in Silicon Valley, and serving as an outside adviser to several seed-round startups, Gary Alexander has exposure to many of the themes shaping the industry today. He has been a regular contributor on Seeking Alpha since 2017. He has been quoted in many web publications and his articles are syndicated to company pages in popular trading apps like Robinhood.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

8 Steps On The Path To Greatness For New Real Estate Agents

October is New Agent Month at Inman. Follow along as we go deeper on the tools, tech and tips you’ll need to survive and thrive in 2024. For curated content crafted just for first-year agents, be sure to subscribe to our weekly newsletter, The Basics.

October is New Agent Month at Inman. Follow along as we go deeper on the tools, tech and tips you’ll need to survive and thrive in 2024. For curated content crafted just for first-year agents, be sure to subscribe to our weekly newsletter, The Basics.

The journey to greatness in real estate isn’t just about discipline or ambition; it’s about the intricate process of transformation. It’s about turning potential into habit, habit into resilience and resilience into success. Here’s how that journey unfolds, step by step, in this high-stakes industry.

Step 1: Discipline breeds habits

In real estate, discipline is your foundation. Without it, you’re just another face in the crowd. This industry doesn’t just demand discipline in your day-to-day; it requires you to embody it. Whether it’s consistently following up with leads, maintaining impeccable property knowledge or constantly learning about new market trends, discipline creates a structure. It’s your daily grind that eventually morphs into habits.

Think about the top agent who wakes up at 5 a.m. every morning, not because they have to, but because they’ve built a routine around discipline. They’re not checking the latest real estate news over coffee; they’re analyzing market data, refining their strategies and planning the day’s outreach to high-net-worth clients. Discipline here isn’t just a word; it’s a way of life.

Step 2: Habits lead to consistency

As habits take root, they form consistency. In real estate, consistency is what separates the contenders from the pretenders. Clients expect more than one-off successes; they want someone who delivers time and time again. Consistency builds your reputation, making you a reliable entity in an industry driven by trust and exclusivity.

Think about the agent who always responds to clients within two hours, regardless of the time or day. It’s this habit of immediate response that breeds trust. Over time, clients know they can count on this broker, reinforcing the broker’s image as someone who is dependable and deeply invested in their success.

Step 3: Consistency fuels growth

With consistency, growth isn’t just possible; it’s inevitable. Growth in real estate isn’t solely about increasing your listings or making more sales. It’s about expanding your understanding of client needs, refining your negotiation tactics and deepening your market expertise. Growth is holistic. It’s as much about your personal evolution as it is about your professional achievements.

Real estate professionals need to grow in multiple dimensions: emotionally, financially and intellectually. For instance, learning to anticipate client needs, understanding the psychology of your potential clients and staying ahead of market trends. This growth doesn’t just happen—it’s fueled by the consistency built through disciplined habits.

Step 4: Growth fosters resilience

Real estate is not for the faint of heart. It’s a market with high expectations and high stakes. Here, resilience is crucial. As you grow, you’ll face setbacks—deals that fall through, clients that disappear, listings that languish on the market. But with every setback, there’s an opportunity to build resilience.

Resilience means learning to stay calm when your deals gets snagged by unforeseen issues. It’s the ability to maintain your composure when a buyer backs out at the last moment. Resilience isn’t about ignoring problems; it’s about weathering them. And as you become more resilient, you also become more capable of handling the unique pressures of this market.

Step 5: Resilience builds confidence

Confidence in real estate is non-negotiable. Your clients need to feel that you’re not just knowledgeable but also unshakably sure of your expertise. Confidence doesn’t mean arrogance; it means trust in your ability to deliver. It’s the professional who can walk a client through a complicated contract without flinching, or the agent who can showcase a property with the kind of assurance that only comes from knowing it inside out.

Confidence in this market also involves a certain level of presence. It’s about exuding the kind of calm, collected assurance that puts clients at ease. After all, they’re not just buying property; they’re buying into you. The confidence you project is the trust they invest in you.

Step 6: Confidence inspires action

In a world where decisions are often made in a heartbeat, action is everything. Real estate clients don’t have the patience for hesitation. They need to see that you can act decisively and effectively. This is where your confidence becomes tangible. It’s no longer just something you feel; it’s something you do.

Think about the agent who sees a market trend shifting and moves quickly to advise their clients, securing a sale before competitors even catch wind. In real estate, hesitation is costly. Action, backed by confidence, is invaluable. The ability to make swift, informed decisions is what sets you apart in a crowded field.

Step 7: Action creates opportunities

Every action in real estate has the potential to open doors. When you act decisively, you not only solve problems but also create opportunities. Maybe it’s a chance to network with a high-profile developer or an opportunity to represent a property that elevates your brand. In this industry, every bold step can lead to new prospects.

Real estate is about more than just transactions; it’s about relationships. By acting confidently, you show potential clients that you’re a proactive, engaged partner. This creates trust and opens the door to future business. When you’re the one making things happen, opportunities come knocking.

Step 8: Opportunities pave the way for success

Success in real estate is rarely an accident. It’s the result of a long chain of disciplined actions, consistent habits, resilient responses and confident decisions. It’s about building a reputation that attracts the kind of clients you want to work with. Success isn’t just about closing a deal; it’s about becoming the go-to name in your market, the one people trust with their most significant investments.

By following this path, from discipline to habits, from resilience to success, you’re not just surviving in real estate—you’re thriving. That’s the ultimate goal. This market doesn’t reward mediocrity. It demands excellence, and only those who are willing to put in the work to build, grow and sustain themselves will find true success.

In real estate, greatness isn’t given; it’s earned. Every agent who achieves it has walked a similar path. They’ve put in the hours, built the habits, grown resilient and acted confidently. They’ve seized opportunities and carved out their own success. If you’re ready to walk this path, know that it’s not easy, but for those who stick with it, the rewards are as grand as the properties they sell.

Chris Pollinger, founder and managing partner of RE Luxe Leaders, is the strategic advisor to the elite in the business of luxury real estate. He is an advisor, national speaker, consultant and leadership coach.

Northern Ireland Fintech Leaders Set Sights on Singapore

Ahead of the 2024 Singapore Fintech Festival (SFF), a delegation of seven innovative tech companies from Ireland and Northern Ireland will be heading to Singapore for a trade mission from November 04 to 08, 2024.

This mission, led by economic development agencies Invest Northern Ireland and Enterprise Ireland, aims to provide promising Irish companies with the opportunity to explore market opportunities in Singapore, make new business connections and grow their exports.

It will comprise prominent fintech firms Funds-Axis, FD Technologies, FinTrU and Fern Software, as well as leading tech companies Kyber Digital, EOS IT Management Solutions, and Neueda. These companies represent some of the most dynamic and fastest-growing players in Ireland and Northern Ireland’s tech and fintech sectors.

Featured Irish companies

Funds-Axis, a regtech company, specializes in simplifying the complexities of risk, compliance and regulatory reporting. With a combination of regulatory expertise and best-of-breed technology, the company offers a single multi-modular platform for a range of investment compliance and regulatory reporting. Its clients include leading global asset managers, fund administrators, hedge funds and depositary banks in the UK, Ireland, Europe and North America.

FD Technologies is a group of data-driven businesses across three key business divisions: KX, the leading technology for real-time continuous intelligence; First Derivative, a provider of technology-led services in capital markets; and MRP, the only enterprise-class, predictive accounts based marketing solution. FD Technologies operates from 15 offices across Europe, North America and Asia Pacific, and employs more than 2,500 people worldwide.

FinTrU is renowned for its expertise in know-your-customer (KYC), compliance, risk and legal. The company develops technology-enabled client lifecycle management solutions for leading global financial institutions. It operates out of offices in Belfast, Derry/Londonderry, London, Letterkenny, New York and Porto.

Fern Software is a leading provider of banking software for inclusive financial institutions such as microfinance institutions, credit unions, small and medium-sized enterprise (SME) lenders and development banks. Incorporated in 1979, the company has a global presence with over 300 sites in 40+ countries, 3 million borrowers and offices in Amsterdam, Belfast, Singapore, Tiruchirappalli and Toronto.

Kyber Digital is a full-service digital agency set-up over 20 years ago with extensive experience in the creation of websites, phone apps and web apps. The agency has completed more than 3,000 projects, has a client base exceeding 700, and says it has won more than 15 awards.

EOS IT Solutions is a family-run global tech and logistics company, providing collaboration and business IT support services to some of the world’s largest industry leaders. EOS IT Solutions provides its customers with leading technologies to strengthen their business infrastructures. The company has more than 20 offices worldwide and employs over 2,300 people.

Finally, Neueda, founded in 2002, helps organizations unlock the potential of their people and leadership teams through a winning combination of training, coaching and mentoring. The company specializes in software engineering, cloud platforms, data science and artificial intelligence (AI).

Northern Ireland: a leading fintech hub

Northern Ireland has become a global fintech hub, boasting a vibrant ecosystem of local innovators and international financial services leaders. Today, the region is recognized as one of the high-growth fintech regions in the UK with major US players such as Citibank growing towards 4,000 people. It also claims the highest concentration of fintech employment in the UK, with one in five people working across the financial and tech sectors in Northern Ireland.

This success is partly fueled by the global expansion of prominent Irish fintech companies such as Options Technology, Lightyear, Datactics and Regtick. These companies are increasingly looking to scale their operations internationally, with Asia identified as a key growth market.

The upcoming trade mission underscores the commitment of both Ireland and Northern Ireland to fostering this growth and supporting domestic fintech companies in their pursuit of an expansion into Asia.

Singapore, known for being one of the most open and competitive economies in the world, is currently the fourth-largest global financial center and a gateway location to business growth in Southeast Asia. Recognizing this, Northern Ireland has identified significant export opportunities for its fintech and broader tech sectors within Singapore, and has forged growing ties with the nation to build trade links and help Irish companies to scale to the market.

SFF will be back for its 9th edition from November 06 to 08, 2024, bringing together a prestigious lineup of global central bankers, regulators, industry leaders, entrepreneurs, investors, innovators, and influencers to foster collaboration and shape the future of the global financial ecosystem.

This year’s event will examine the transformative potential of AI and quantum computing in revolutionizing financial services and to deliver sustainable and inclusive economic growth. As the world continues to deal with the challenges of climate change, SFF 2024 will also highlight the role of fintech in driving sustainable finance.

SFF is an annual fintech event organized by the Monetary Authority of Singapore and Elevandi and Constellar, in collaboration with the Association of Banks in Singapore. Since its inception in 2016, SFF has become a premier platform for the global fintech community to engage, connect, and collaborate on issues relating to the confluence of financial services, public policy, and technology. Last year’s edition brought together 66,000 participants from 150 countries.

Visit the Ireland & Northern Ireland stand at the upcoming Singapore Fintech Festival in Hall 5, Booth #5F29. If you wish to learn more about Northern Ireland’s thriving tech industry, visit this website.

Your Guide to Purchasing a Home Security System

In today’s world, home security has become a top priority for homeowners looking to protect their property and loved ones. With burglaries and home invasions a constant concern, investing in a reliable home security system can provide invaluable peace of mind. Beyond deterring potential intruders, modern security systems offer many benefits, from protecting your home to integrating with smart technology for added convenience.

Types of Home Security Systems

1. Monitored Systems

Monitored home security systems are among the most comprehensive options available. These systems are professionally monitored 24/7, meaning that trained professionals will respond immediately if an alarm is triggered. The primary benefit of a monitored system is constant oversight, ensuring that emergency services are contacted even if you’re not home or unable to call for help. While these systems may come with higher installation and monthly fees, their reliability and fast response times make them ideal for homeowners seeking robust protection.

2. DIY Systems

DIY security systems are becoming increasingly popular for their affordability and ease of installation. These systems are typically wireless and come with customizable components, allowing homeowners to tailor the setup to their needs. While DIY systems generally don’t include professional monitoring, many offer remote monitoring through a mobile app, allowing you to monitor your home from anywhere. These systems are perfect for tech-savvy homeowners looking for flexibility and control over their security.

3. Wireless vs. Wired Systems

Wireless and wired home security systems each have their pros and cons. Wireless systems are easy to install, making them ideal for renters or homeowners who want a hassle-free setup. They are also portable, allowing them to be easily moved or expanded. However, they rely on Wi-Fi, which could be a vulnerability if the connection drops. On the other hand, wired systems offer more stable connections and don’t depend on wireless signals. Still, their installation is more complex, often requiring professional assistance and permanent fixtures within the home.

Features to Consider

When choosing a home security system, including essential components that provide enhanced protection is critical. Here are key features to keep in mind:

- Cameras: Essential for monitoring entrances and vulnerable areas around your home.

- Sensors: Placed on windows and doors to detect any unauthorized entry.

- Alarms: Effective deterrents for burglars, alerting you and your neighbors of a break-in.

- Smart Home Integration: Many systems can control locks, lights, and cameras remotely through a smartphone app, making it easier to monitor your home from anywhere.

Choosing the Right System

Several factors should guide your decision when selecting a home security system:

- Budget: Systems vary widely in cost based on features and whether professional monitoring is included.

- Home Size: The size of your home determines how many cameras and sensors you’ll need.

- Neighborhood: Consider your neighborhood’s safety. Homes in higher-crime areas may require more advanced security features.

- Comprehensive Detection: Look for systems that offer additional protection, such as smoke and carbon monoxide monitoring and burglary protection.

Secure Your Home with the Right System

Purchasing the right home security system involves understanding the options available and choosing one that fits your needs. Whether you opt for a monitored system or a DIY setup, the right system can help protect your home and family. As you explore your options, consider the features, installation process, and costs that make the most sense for your home. Prioritizing home security gives you peace of mind that your property is safe, whether at home or away. To learn how home security systems affect your insurance coverage, talk to one of our local insurance agents today.