Society Pass Inc. (NASDAQ: SOPA) has announced that it has entered into a structured financing agreement with Strattners FZCO to access capital efficiently. According to the agreement, SoPa can sell its common stock to Strattners worth up to $40,000,000 on SoPa’s request during the next 36 months, subject to certain limitations. The Company plans to use this capital in its operating subsidiaries, including Thoughtful Media Group Inc. and NusaTrip Inc., to invest in acquisitions and strengthen its working capital. The financing strategy will be implemented only when market conditions for SoPa’s common stock are favorable.

Company Overview

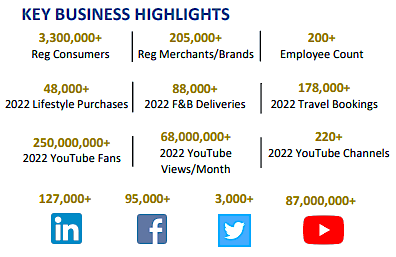

SoPa is a data-driven ecosystem that was founded in 2018. It focuses on loyalty, fintech, and e-commerce in the rapidly growing markets of Vietnam, Indonesia, Philippines, Singapore, and Thailand. These countries account for more than 80% of the population in Southeast Asia. SoPa operates six interconnected verticals, including loyalty, digital media, travel, telecoms, lifestyle, and F&B, and has offices in Los Angeles, Bangkok, Ho Chi Minh City, Jakarta, Manila, and Singapore. It seamlessly connects millions of registered consumers and hundreds of thousands of registered merchants and brands across multiple product and service categories throughout Southeast Asia, with a critical focus on acquisitions.

SoPa is a data-driven ecosystem that was founded in 2018. It focuses on loyalty, fintech, and e-commerce in the rapidly growing markets of Vietnam, Indonesia, Philippines, Singapore, and Thailand. These countries account for more than 80% of the population in Southeast Asia. SoPa operates six interconnected verticals, including loyalty, digital media, travel, telecoms, lifestyle, and F&B, and has offices in Los Angeles, Bangkok, Ho Chi Minh City, Jakarta, Manila, and Singapore. It seamlessly connects millions of registered consumers and hundreds of thousands of registered merchants and brands across multiple product and service categories throughout Southeast Asia, with a critical focus on acquisitions.

SoPa utilizes advanced technology to provide a more personalized experience for customers during their purchasing journey and to revolutionize the entire retail value chain in Southeast Asia (SEA). The Company operates several subsidiaries, including Thoughtful Media Group, a Thailand-based social commerce-focused premium digital video multi-platform network; NusaTrip, a leading online travel agency in Indonesia; VLeisure, which offers hotel management and payment solutions and is Vietnam’s leading provider; Gorilla Global, a mobile network operator based in Singapore; Leflair.com, Vietnam’s top lifestyle e-commerce platform; and NextGen Retail, an e-commerce platform based in Indonesia.

SoPa utilizes advanced technology to provide a more personalized experience for customers during their purchasing journey and to revolutionize the entire retail value chain in Southeast Asia (SEA). The Company operates several subsidiaries, including Thoughtful Media Group, a Thailand-based social commerce-focused premium digital video multi-platform network; NusaTrip, a leading online travel agency in Indonesia; VLeisure, which offers hotel management and payment solutions and is Vietnam’s leading provider; Gorilla Global, a mobile network operator based in Singapore; Leflair.com, Vietnam’s top lifestyle e-commerce platform; and NextGen Retail, an e-commerce platform based in Indonesia.

Business Unit Description

SoPa aims to meet the growing demand for better services in Asia by acquiring market-leading companies and partnering with visionary entrepreneurs. The Company focuses on six verticals, as discussed below.

Loyalty

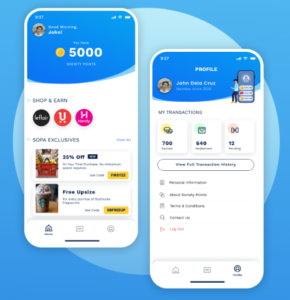

SoPa Loyalty offers a universal, open-loop loyalty platform that generates permanent customer loyalty, replaces cash discounting, and creates additional revenues for merchants. The platform helps merchants retain existing customers, attract new ones, reduce customer turnover, and sync customer data in real time. Personalized marketing campaigns are also part of the SoPa Loyalty package.

SoPa Loyalty offers a universal, open-loop loyalty platform that generates permanent customer loyalty, replaces cash discounting, and creates additional revenues for merchants. The platform helps merchants retain existing customers, attract new ones, reduce customer turnover, and sync customer data in real time. Personalized marketing campaigns are also part of the SoPa Loyalty package.

Digital Media

Thoughtful Media Group (TMG) is a Los Angeles-based company that operates a global multi-platform network. TMG has generated tens of millions of dollars in advertiser-branded content and deployed thousands of videos that have garnered billions of views across social media platforms such as YouTube, Daily Motion, and Facebook. It has also sourced hundreds of Asian content producers and digital media/product developers and launched brands into the markets of Thailand, Vietnam, the Philippines, China, and the US. Over the years, Thoughtful Media Group has gathered social influencer data, which it now uses to track 1 billion authenticated global video views a month across key social platforms.

Thoughtful Media Group (TMG) is a Los Angeles-based company that operates a global multi-platform network. TMG has generated tens of millions of dollars in advertiser-branded content and deployed thousands of videos that have garnered billions of views across social media platforms such as YouTube, Daily Motion, and Facebook. It has also sourced hundreds of Asian content producers and digital media/product developers and launched brands into the markets of Thailand, Vietnam, the Philippines, China, and the US. Over the years, Thoughtful Media Group has gathered social influencer data, which it now uses to track 1 billion authenticated global video views a month across key social platforms.

Travel

NusaTrip is a leading online travel agency (OTA) in Southeast Asia that provides services to individuals and businesses. They have connected more than 80 million unique visitors with over 500 airlines and 200,000 hotels worldwide through various local payment options. NusaTrip has partnerships with low-cost carriers in Asia and full-service airlines globally, enabling them to offer real-time global fare shopping to help travelers find the best deals. They also work with hotel wholesalers in multiple countries to provide real-time price optimization for their customers.

NusaTrip is a leading online travel agency (OTA) in Southeast Asia that provides services to individuals and businesses. They have connected more than 80 million unique visitors with over 500 airlines and 200,000 hotels worldwide through various local payment options. NusaTrip has partnerships with low-cost carriers in Asia and full-service airlines globally, enabling them to offer real-time global fare shopping to help travelers find the best deals. They also work with hotel wholesalers in multiple countries to provide real-time price optimization for their customers.

Lifestyle

Leflair is an online shopping platform that provides access to over 3,500 Vietnamese and international brands in fashion, accessories, beauty, personal care, and home furnishings. It helps to expand markets by enabling local brands to sell their products internationally and foreign brands to enter new markets. Additionally, Leflair has filter and search programs designed to optimize the user’s shopping experience.

Leflair is an online shopping platform that provides access to over 3,500 Vietnamese and international brands in fashion, accessories, beauty, personal care, and home furnishings. It helps to expand markets by enabling local brands to sell their products internationally and foreign brands to enter new markets. Additionally, Leflair has filter and search programs designed to optimize the user’s shopping experience.

Telecom

Gorilla is a mobile virtual network operator based in Singapore that leverages blockchain and web3 technology. It has plans to expand into Malaysia, Vietnam, and Thailand and aims to increase its registered user base to over 50,000 while driving app downloads to over 20,000. Gorilla offers an innovative suite of services that include e-SIM cards, local calling, international roaming, data, and SMS texting. These services are entirely owned by the users, allowing for easy transfer or sharing via blockchain wallets.

Gorilla is a mobile virtual network operator based in Singapore that leverages blockchain and web3 technology. It has plans to expand into Malaysia, Vietnam, and Thailand and aims to increase its registered user base to over 50,000 while driving app downloads to over 20,000. Gorilla offers an innovative suite of services that include e-SIM cards, local calling, international roaming, data, and SMS texting. These services are entirely owned by the users, allowing for easy transfer or sharing via blockchain wallets.

Food & Beverage

In this vertical, there are three primary businesses.

– Pushkart is a prominent online grocery delivery application in Metro Manila, with an average transaction amount of $40. This unit aims to expand its merchant coverage to 25 grocery stores, extend its reach to 10 new Philippine cities, increase its registered users to over 300,000, and boost app downloads to over 150,000.

– Pushkart is a prominent online grocery delivery application in Metro Manila, with an average transaction amount of $40. This unit aims to expand its merchant coverage to 25 grocery stores, extend its reach to 10 new Philippine cities, increase its registered users to over 300,000, and boost app downloads to over 150,000.

– Handycart is an online grocery delivery app based in Vietnam. It specializes in serving the Korean restaurant market in Hanoi. Handycart plans to expand its merchant coverage to 500 restaurants in Hanoi and aims to enter the HCMC market. Handycart is also looking to increase its registered user base to over 500,000 and drive app downloads to more than 200,000.

– Handycart is an online grocery delivery app based in Vietnam. It specializes in serving the Korean restaurant market in Hanoi. Handycart plans to expand its merchant coverage to 500 restaurants in Hanoi and aims to enter the HCMC market. Handycart is also looking to increase its registered user base to over 500,000 and drive app downloads to more than 200,000.

– Mangan is a popular food delivery app operating on Luzon Island. It charges merchants a commission of at least 20 percent and delivery fees. On average, each transaction through the app amounts to around US$13. Mangan aims to increase its registered user base to over 500,000 and achieve over 150,000 app downloads.

– Mangan is a popular food delivery app operating on Luzon Island. It charges merchants a commission of at least 20 percent and delivery fees. On average, each transaction through the app amounts to around US$13. Mangan aims to increase its registered user base to over 500,000 and achieve over 150,000 app downloads.

The Company completed an initial public offering and started trading on Nasdaq under the ticker SOPA in November 2021.

Below, we will discuss the critical rationale for covering this Company.

1. THRIVING MARKET OPPORTUNITY

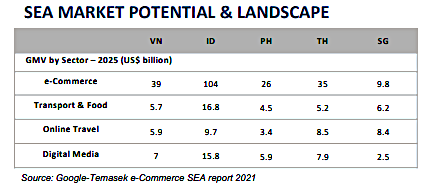

SEA is experiencing strong economic growth, a rise in population and urbanization, an increase in the middle class, and a growing adoption of mobile technology. These factors provide market opportunities for the Company.

As of 2020, the gross domestic product (GDP) of Southeast Asia (SEA) was $3.1 trillion, which is significantly lower than the GDP of the European Union (EU) and the United States (US), which were $15 trillion and $20.8 trillion respectively in 2020. However, SEA has seen tremendous economic growth in recent years, surpassing growth in major world economies such as Japan, the EU, and the US. According to the International Monetary Fund (IMF), since 2010, SEA has averaged 4.6% GDP growth, while Japan, the EU, and the US have only achieved 0.7%, 0.8%, and 1.7%, respectively.

Southeast Asia (SEA) is experiencing significant population growth and a thriving internet economy. According to the United Nations Population Division, the population of SEA countries in 2000 was around 525 million, and it has since grown to an estimated 668 million in 2020. Furthermore, the region’s internet usage is increasing rapidly. The Google Temasek e-Conomy Report shows that in 2020, 40 million new users joined the internet in the region, bringing the total number of users to 400 million from 360 million in 2019 – this means that 70% of SEA’s population is now online, compared to just 20% in 2009. Additionally, mobile internet penetration in SEA now exceeds 67%, and the internet sector’s gross merchandise value (GMV) is projected to surpass $300 billion by 2025.

SoPa’s growth is expected to be supported by these macro factors in the coming years.

2. ROBUST GROWTH STRATEGY

The Company has an effective growth strategy to make the most of upcoming market opportunities. Key elements of the growth strategy include:

- Acquisitions:

The Company plans to acquire e-commerce companies to expand the SoPa ecosystem throughout Southeast Asia, focusing on Vietnam, the Philippines, and Indonesia.

The Company’s most noteworthy acquisition is Thoughtful Media, a digital media platform that enhances the reach and engagement of the Company’s e-commerce ecosystem and retail partners. Thoughtful Media creates and distributes digital advertising campaigns across its multi-channel network in SEA and the US. Its data-rich multi-channel network has uploaded over 675,000 videos with over 80 billion views. The current network of 263 YouTube channels has onboarded over 85 million subscribers with an average monthly viewership of over 600 million views. According to Accenture, the social commerce market is expected to grow to $1.2 trillion by 2025 with a CAGR of 26%. SoPa is poised to reap the full benefits of this upcoming expansion through this acquisition.

In July 2023, SoPa announced that its online retail platform, NusaTrip, had acquired Vietnam International Travel and Service JSC, Indonesia’s first IATA-licensed travel agency. The acquisition added US$2 million in GMV to NusaTrip

‘s revenue base.

Therefore, the Company aims to acquire additional e-commerce platforms and applications across various sectors to expand its service offerings and attract new consumers and merchants. - Loyalty System:

SoPa introduced its universal loyalty application, the Society Pass Loyalty Wallet, on June 28, 2023. This application will enable consumers and merchants to conveniently purchase, earn, and redeem loyalty points called Society Points. With Society Points, consumers can use a cashless payment option and transfer bonus points earned from one vertical, such as lifestyle, to another, such as travel.

Since its inception in 2018, the Company’s vision has been to build the next-generation digital ecosystem and loyalty platform in Southeast Asia. This vision has attracted over 3.3 million registered users and over 650,000 registered merchants. SoPa plans to integrate all its ventures within the ecosystem into the Loyalty App by the end of Q4 2023 – this will enable the Company to provide a seamless shopping experience across its network of over 650,000 merchants.

SoPa’s loyalty system aims to increase customer loyalty and generate additional revenue for merchants across multiple verticals in SEA. Thus, this initiative should help the Company strengthen and improve its hold across consumers in various verticals.

- Strategic Partnerships:

In August 2023, Society Pass (SoPa) announced a strategic partnership with 2C2P, a full-suite global payments platform headquartered in Singapore. The objective of this partnership is to drive e-commerce shopping in Southeast Asia. With the collaboration, Society Pass’s loyalty app will be able to offer 2C2P’s extensive range of alternative payment options to customers based in the Philippines and Indonesia.

A recent IDC InfoBrief commissioned by 2C2P forecasts a 121% increase in spending on Southeast Asia’s digital economy by 2026. It also predicts that digital payments will comprise 92% of the total digital economy payments by 2026, up from 80% in 2020. SoPa, to take full advantage of this opportunity, has partnered with 2C2P.

Another noteworthy partner is Amilo, a Vietnam-based delivery company. Through this Lifestyle Vertical partnership, SoPa offers a convenient and hassle-free delivery service of products from the merchant directly to the consumer’s home or office with just a tap of a button.

Strategic partnerships are essential for the success of the Society Pass ecosystem. Such collaborations help the platform offer more value-added services to both consumers and merchants. In addition, partnerships enable SoPa to access its partners’ clients and users at minimal cost and to promote the use of Society Points (when they are available) more widely. - Maximizing Consumer Transactions:

The Company’s main growth drivers for its verticals are increasing its consumer base, converting registered consumers into active ones, boosting transaction frequency, and maximizing basket sizes. To achieve this, SoPa adopts a comprehensive marketing approach that includes social media, email, SMS, QR codes, tailored promotional campaigns, and public relations engagement to grow its base of registered consumers.

In October 2023, Thoughtful Media Group (TMG) announced their plans to launch their first concert in Jakarta, Indonesia, in the fourth quarter of FY23. These concerts will be streamed on TMG-affiliated social media channels, allowing advertisers to collaborate with TMG-connected influencers to promote these popular music events and reach their desired audiences. TMG aims to reach over 2.5 million people through these live events over the next year, creating significant sponsorship opportunities for advertisers and the 10,000-member influencer community in Indonesia. TMG plans to host one monthly concert, with projected annual earnings of $680K.

In this way, by providing innovative solutions for every aspect of consumers’ daily lives, the Company can increase opportunities for cross-selling and maximize consumer wallet share.

- Expanding Service Offerings To Benefit Merchants:

SoPa recognizes the importance of merchants in its business and is dedicated to growing its registered merchant base. To achieve this goal, the Company provides merchants with cutting-edge technology and marketing solutions that help to improve their sales, reduce costs, and increase operational efficiency. Marketing outreach tools such as websites, public relations, social media, and targeted sales efforts are used to onboard new merchants.

In October 2023, Thoughtful Media Group announced the launch of the first-ever MediaGram, “Sit Up”. The project is a partnership with Indonesian superstar actor and producer Chicco Jerikho. It aims to develop an online community that promotes a healthy and fitness-centric lifestyle in Indonesia. TMG expects to create new revenue models through this partnership with fitness clubs and clothing retailers. In other words, the Company aims to develop innovative strategies that benefit existing and new merchants, resulting in overall growth.

3. RECENT FINANCIAL PERFORMANCE

SoPa announced its Q2 FY23 results in August 2023, revealing a remarkable growth of 338.3% YoY in revenues, which increased from $499,062 in Q2 FY22 to $2,187,232 in Q2 FY23. Additionally, the Company’s gross profit improved significantly from a Q2 FY22 gross loss of $138 to $577,159 in Q2 FY23. Furthermore, the Q2 FY23 gross margin increased to 26.4%, a remarkable improvement from the Q2 FY22 gross margin of 0.0%.

In the first half of FY23, the Company experienced a substantial growth of 348% YoY in revenues in the five largest economies of Southeast Asia. Additionally, the Company’s cash operating expenses decreased by 28% in the same period. Another significant improvement is the gross margin, which increased from a negative 1.6% in H1 FY22 to 29.9% in H1 FY23.

As of March 31, 2023, the Company had a strong balance sheet with cash on hand of $10.8 million ($0.38 per share) and a book value of $12.7 million ($0.45 per share).

The Company has shown impressive growth in both revenue and profit margins. It is confident it will achieve cash profitability in the second half of the fiscal year 2023. Based on its past performance, it seems that SoPa will keep its promises. Despite only acquiring its two principal subsidiaries, Thoughtful Media and NusaTrip, in the second half of the fiscal year 2022, both subsidiaries contributed over 90% of SoPa’s revenues in the first half of the fiscal year 2023.

Both of these subsidiaries are anticipated to significantly contribute to the Group’s revenue and profits in the second half of fiscal year 2023. NextGen Retail, the third-largest subsidiary of SoPa, recently acquired a significant retailer of Apple products in Indonesia. As a result, it is expected that NextGen Retail will experience rapid growth in the second half of fiscal year 2023, and these two crucial verticals will drive the Company towards cash profitability in the second half of fiscal year 2023.

RISK ASSESSMENT

Based on the information provided, the Company has a promising future. However, it is also exposed to certain risks. Firstly, SoPa operates in a highly competitive internet-based e-commerce space and competes with other companies that offer similar user-vendor connection experience, payment processing, funds transfer content, and marketing data services. Some of these competitors may have better industry experience or financial resources than the Company, and as a result, SoPa may not have sufficient resources to compete effectively.

It’s important to note that SoPa’s platform operates in a new and untested market, making it challenging to anticipate customer adoption and renewal rates. Additionally, it’s difficult to gauge the demand for SoPa’s solutions, the overall market size and growth rate that the platform addresses, the potential entry of competitive products, and the success of existing ones.

Thirdly, the Company’s revenue heavily relies on the number of successful user transactions completed. Any system interruptions or decreased demand for the goods and services offered on the platform could have negative financial implications for the Company.

CONCLUSION

SoPa was established in 2018 and has experienced remarkable growth in just six years. The Company reported a 338.3% year-over-year increase in Q2 FY23 revenues and achieved a positive gross margin of 26.4%.

The Company aims to revolutionize the retail chain value in Southeast Asia through its innovative technology and platform. Its ultimate goal is to provide personalized experiences to customers. SoPa relies heavily on acquisitions to achieve this. The Company has a strong cash position to support this strategy and recently entered into a structured finance agreement with Strattners FZCO. Based on its track record, SoPa has the expertise and experience to seamlessly integrate newly acquired companies into its platform.

SoPa appears to have all the necessary capabilities to revolutionize and take over the retail chain in Southeast Asia. However, the Company faces tough competition, and the SoPa platform market is still in its early stages, potentially affecting its prospects. Therefore, it is advisable to exercise caution when considering any investment in the Company.

Reference:

https://thesocietypass.com/investor-relations/

https://www.acnnewswire.com/press-release/english/87000/society-pass-inc-(nasdaq:-sopa)-announces-equity-line-of-up-to-$40-million-to-invest-into-operating-subsidiaries-projected-to-go-public-in-2024

https://www.sec.gov/ix?doc=/Archives/edgar/data/1817511/000160706223000144/sopa123122form10k.htm

https://alvinology.com/2023/07/01/society-pass-launches-loyalty-app-and-points-system-in-southeast-asia/

https://acnnewswire.com/press-release/english/85682/

https://www.acnnewswire.com/press-release/english/85398/

https://sopa-public-picture.s3.ap-southeast-1.amazonaws.com/2023.10.24_TMG_Concert_PressRelease.pdf

https://finance.yahoo.com/news/society-pass-inc-nasdaq-sopa-121700021.html

https://acnnewswire.com/press-release/english/85761/

https://www.sec.gov/ix?doc=/Archives/edgar/data/1817511/000160706223000393/sopa063023form10q.htm