Gary and Jay write in Your First Home, “Markets go up and down. The reality is there’s never really a perfect market—just the market you’re dealing with when you’re buying your home.” Mirroring this quote, the market in 2024 and 2023 has given buyers challenges – and opportunities.

June is National Homeownership Month, and it’s a good time to check in on the challenges and opportunities that buyers are dealing with. To help yourself become the economist of choice for your clients, here are some key takeaways from the National Association of Realtors ® (NAR) annual Home Buyers and Sellers Report. If you want bonus points, you can also check on our recap from last year here.

First-Time Buyers

Low inventory and high interest rates have roughly stabilized, with some new construction helping ease both price points and availability. The result is more first-time buyers successfully purchased in the past year.

- First-Time Buyers Were 32 Percent of Overall Buyers in 2023, Up from 26 Percent in 2022

A glimmer of good news is that more people are entering their homeownership journey. This past year’s increase is welcome: 2022 had the lowest amount of first-time home buyers since NAR started collecting data in 1981. Still, the average for most of NAR’s records is 38 percent, so this market is still lower than historical norms. - A Typical First-Time Buyer Is About the Same Age: Mid-Thirties

The average age of a first-time buyer was reported to be 35 years old, down from 36 years old last year. The combination of student loan debt and high cost of living means delaying homeownership until savings can be built up. - The Pride of Homeownership Remains Strong

Over half of first-time buyers (60 percent) reported that the primary reason for purchasing a home was the desire to own a home of their own.

Repeat Buyers

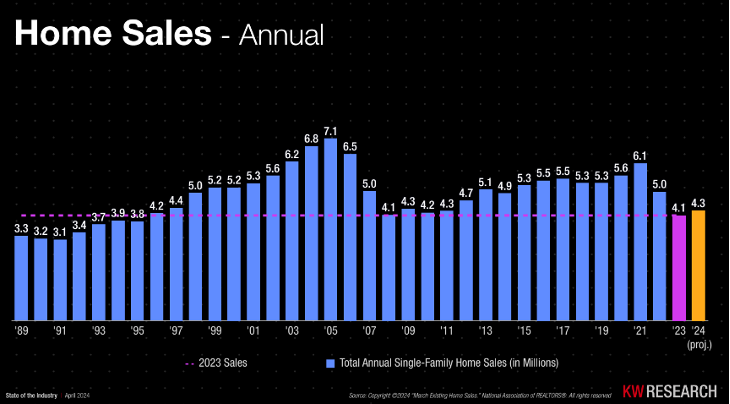

In 2023, there were a recorded 4.1 million home sales, which is one of the lowest numbers in recent history. This number is the same as it was in 2008, when the Great Recession, an economic downturn that began in late 2007 and lasted until 2009, was beginning to take place. Economists are projecting 4.3 million home sales in 2024, about the same as the period immediately following the recession, from 2009-2011. And, as the preceding graph illustrates, sales are trending up.

- Houses Before Legal Spouses

Last year saw the lowest percentage of first-time buyers who were married couples in over ten years with only 9 percent of buyers being wed. Still, married couples accounted for the largest percentage (59 percent) of recent buyers. Single females remain strong as 19 percent of recent buyers. - Continuing Presence of Multi-Generational Housing

As the cost-of-living increases with inflation, many families are finding buying power and stability in purchasing homes beyond immediate families. Fourteen percent of home buyers purchased a multi-generational home, planning to take care of aging parents and children while pooling resources. This number has held steady from last year.

For home buyers wading into the changing market tides and making moves, some interesting trends emerged:

- People Are Moving to Avoid Renovations

Forty-five percent of most recent buyers who purchased new homes were looking to avoid renovations and problems with plumbing or electricity. - Decrease in Home Prices

With the markets softening in areas, historically high home prices are coming down in some markets. Move-up buyers reported that 38 percent of them purchased their new homes because of better prices. - Speed to Lead Matters

In what seems to be an evergreen trend, being top-of-mind remains critical. A remarkable 71 percent of buyers interviewed only one real estate agent during their home search.

The dream of homeownership is alive and well, and a challenging market means that real estate agents will be able to provide better guidance and service. As the real estate industry keeps its eyes on interest rates, agents would do well to keep their ears to their local markets. By keeping in touch with challenges that might matter most to your area, you’ll be able to help buyers navigate their next big move.

Looking for more homeownership resources?

Head over to the Your First Home webpage for freebies, including information on how to build out your real estate dream team and for your clients, a resource on how to determine their homeownership criteria. Also, check out Win Big with Seminars: Your First Home for a complete seminar package including customizable presentations, a social marketing plan, email templates, checklists, and more!